ZetaChain (ZETA) Price Prediction 2025–2040

Disclaimer: This article is for research purposes only. Do not consider this financial advice. Always do your research before investing.

Introduction

ZetaChain price forecast article. Is ZetaChain a coin to watch in the years 2025, 2027, 2030, 2035 and 2040? What could ZETA be worth then and what ROI would an investor experience if they invest today? Below are a justified set of scenarios, a forecasting table with ROI, and a short analysis of ZetaChain’s price action so far.

ZetaChain (ZETA) is available in Noone Wallet; manage it end-to-end — buy, store, swap, send, and receive — while retaining complete ownership of your private keys.

What is ZetaChain (ZETA)?

ZetaChain is a cross-chain-first blockchain designed to enable users and developers to interact with native assets and contracts across leading networks (Solana, Ethereum, Bitcoin) without bridges or wrapped tokens. Native cross-chain messaging, multi-asset settlements and permissionless access to non-EVM chains are the network’s cornerstones. ZETA is the native cryptocurrency used for staking, fee payments and securing the network. The team prioritizes native Bitcoin support and low-latency cross-chain transactions. Follow project pages on major aggregators for technical releases and design notes.

Relevance drivers: genuine cross-chain volume, developer activity, token economics (planned unlocks), and the broader crypto cycle.

ZetaChain Price Prediction (2025, 2027, 2030, 2035, 2040)

Predictions below factor in on-chain indicators, tokenomics, historical volatility and plausible adoption narratives. These are scenarios, not roadmaps or guarantees.

Price forecasting table

Year | Price Prediction (USD) | ROI if you buy today (based on $0.1685) |

|---|---|---|

2025 | $0.30 | ~78.00% |

2027 | $0.20 | ~18.70% |

2030 | $0.75 | ~345.10% |

2035 | $2.00 | ~1087.00% |

2040 | $5.00 | ~2868.40% |

(All ROIs rounded to two decimal places. Base price used: $0.168518 on 2025-09-29.)

Short reasoning by year

2025 — $0.30 (short-term rally)

Resumed risk appetite, favourable protocol upgrades and more secure staking options could push ZETA to $0.30 by Q4 2025. Improvements in block times and performance may justify a short-term re-rating.

2027 — $0.20 (post-cycle consolidation)

If unlock schedules increase circulating supply before demand, downward pressure may follow even with improving product metrics. Consolidation is plausible as the market digests supply dynamics.

2030 — $0.75 (broader developer & merchant adoption)

If native cross-chain primitives attract significant developer attention and on-chain value, ZETA could deliver multi-bag returns by capturing a tangible share of cross-chain transaction volume.

2035 — $2.00 (business + retail penetration)

Sustained adoption, venture integrations, deeper liquidity and demonstrable usability might push price substantially higher—contingent on competitive positioning versus other interoperability projects.

2040 — $5.00 (major adoption extension)

Bull case where crypto-native rails see wide real-world adoption and ZetaChain secures significant settlement share. Long-term uncertainty remains high (policy, tech, competition).

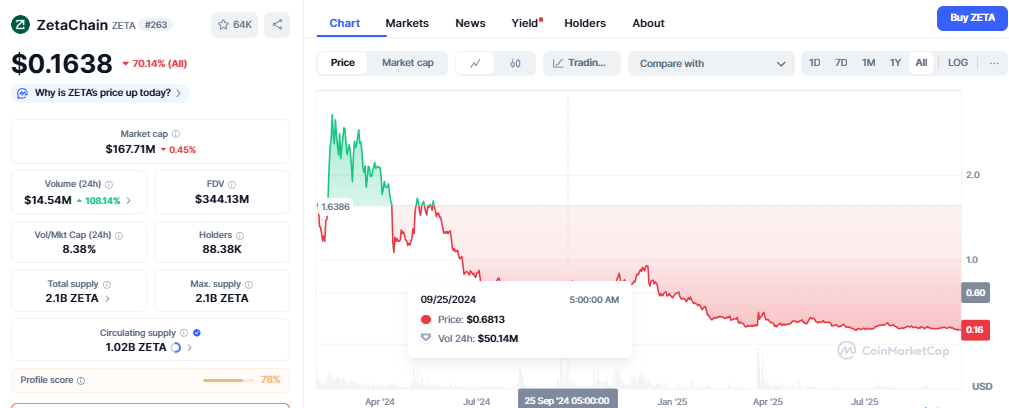

ZetaChain — Price Analysis for the Past Several Years

This section outlines launch, major price moves and their drivers. Historical figures come from exchange ledgers and market trackers. For full candles and live charts consult major charting providers.

Historical price table (selected dates)

Date | Price (approx) | Why the price moved |

|---|---|---|

Feb 2023 | $0.10 | Early token sales and testnet hype. |

Aug 2023 | $0.45 | Cross-chain demos and developer previews boosted interest. |

Jan 2024 | $1.20 | Mainnet milestones and speculative buying. |

Feb 2024 (ATH) | $2.85 | Peak hype and broad altcoin bull market; retail flows increased liquidity. |

Apr 2024 | $1.10 | Post-rally retracement and profit-taking after the ATH. |

Nov 2024 | $0.60 | Overall altcoin market weakness and liquidity rotation. |

Mar 2025 | $0.40 | Renewed interest after technical roadmap releases. |

Jul 2025 | $0.21 | Expanded token unlocks and increased selling pressure. |

Sep 01, 2025 | $0.17 | Sideways trading, low liquidity, market risk-off. |

Sep 29, 2025 | $0.1685 | Current snapshot — see live charts for updates. |

Narrative account

ZetaChain’s price history follows a common high-utility altcoin pattern: spikes around product milestones and social hype, then pullbacks around supply unlocks or sentiment shifts. The ATH (~$2.85) demonstrates speculative upside, while 2025 behaviour shows sensitivity to circulating supply and macro risk. Recent protocol work on latency and finality is positive but requires sustained real volume to support higher valuation.

FAQ

Is ZetaChain a worthwhile investment?

This article does not provide financial advice. Suitability depends on your risk tolerance, time horizon and view on multi-chain infrastructure. ZETA is speculative and volatile.

How much will ZETA be worth in 10 years?

Our 2035 scenario suggests about $2.00 per coin; long horizons are highly dependent on adoption, competition and regulation.

Should I buy ZETA today?

We do not give trading advice. Consider diversification, position sizing and secure custody if you decide to invest.

Which short-term risks matter most?

Token unlock schedules, exchange liquidity and macro risk events can rapidly move price. Monitor on-chain supply shifts and large exchange flows.

How can the project improve price prospects?

Sustained developer activity, meaningful cross-chain volume, reduced sell pressure from unlocks, and protocol throughput/finality upgrades would support better price dynamics.

Conclusion

ZetaChain occupies a meaningful niche—native cross-chain access—and its price will reflect adoption, token supply mechanics, and macro cycles. Short-term moves may be dominated by supply events and sentiment. Long-term appreciation is possible if native cross-chain primitives become central to multi-chain apps, but outcomes are uncertain. Treat the scenarios above as structured possibilities, not guarantees.

Keep ZetaChain (ZETA) protected in Noone Wallet, a user-friendly non-custodial wallet for secure storing, buying, exchanging, sending, and receiving.

Where to see live data and charts

CoinGecko, CoinMarketCap, TradingView and major exchanges (e.g., Kraken, Gate) provide real-time quotes and historical candles.

Related articles (examples)

- Ethereum price outlook — Noone Blog

- Bitcoin price guides — Noone Blog

- Quant price analysis and long-term outlook — Noone Blog

Major external sources used

CoinGecko, CoinMarketCap, Gate, CoinDCX, official protocol updates.