Tom Lee's Current Opinion Regarding Bitcoin: Breaking it Down

Tom Lee has also emerged to be one of the best known bitcoin analysts in the fields of bitcoin news and bitcoin prediction. The remarks he gives tend to trigger a variety of debates from the community members in an attempt to gain more insight into the operations of the marketplace. The people who tend to search for Tom Lee Bitcoin and Tom Lee Bitcoin prediction are usually in need of the basic reasons behind his positive prognosis.

Bitcoin is found in numerous non-custodial wallets, such as the Noone Wallet, where users are able to securely store their assets while monitoring the changes in the market. The Noone Wallet is a relevant point to make in relation to monitoring changes in the long term but not in terms of prediction.

Tom Lee's Most Recent Bitcoin Forecast

Tom Lee has recently outlined his forecasts for the forthcoming phase of the price cycle of Bitcoin. The central tenet of his belief is positive in nature. Tom Lee consistently asserts that the value of Bitcoin will be able to attain a higher level if the prevailing economic trends keep turning in the right way.

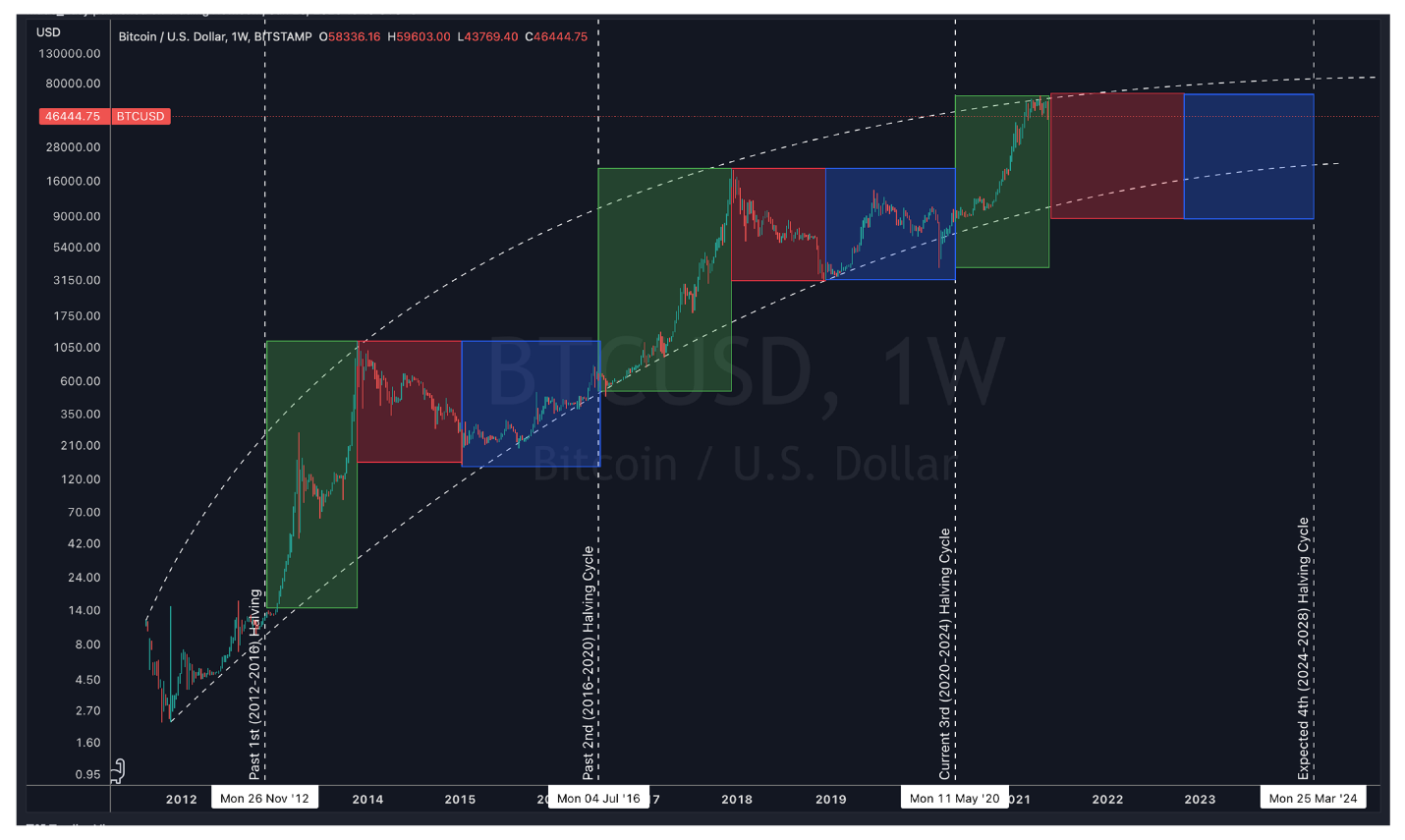

Lee has posted a number of price ranges in the past cycles. The latest quotes by the analyst appear to be targeting six figures if the demand increase continues and the supply is capped. People focus keenly on such opinions because the views are based upon historical trends and economic indicators when the opinions are made.

Tom Lee's prediction is not a guarantee but an interpretation of available information. This is a healthy way to maintain realism with expectations.

Why Tom Lee Thinks Bitcoin Could Hit New Records

Leehas a basis for his optimism in the structural demand that the Bitcoin enjoys. The more bodies that embrace the Bitcoin, the more it becomes impossible to ignore the existence of the asset while the supply of the asset remains constant.

Tom Lee focuses on the way in which Bitcoin functions as an electronic form of value storage for people. The advantage of Bitcoin is its attractiveness to those people who desire to be free from the established banking system models.

The more people who delve into researching Bitcoin, the faster the momentum process, according to Tom Lee.

"So what's the main takeaway?"

Lee forecasts a quicker expansion in the long-term demand than in supply.

Factors Contributing to Tom Lee's Optimistic Bitcoin Outlook

Several elements go into forming Lee's outlook. For instance, he hangs his whole investment execution theory upon the liquidity factor, the wider environment, and investor action.

First of all, the fact that the supply of Bitcoin is limited remains significant. Only a certain number of Bitcoins will ever be in existence. Secondly, the presence of institutional investment will enhance the liquidity of the marketplace. For instance, a stable source of demand will be created through their entry into the marketplace. Thirdly, economic instability will cause people to turn to alternate investments.

All the above factors interact and complement each other. They don't work alone.

How Market Conditions Support Tom Lee's Predictions

Lee asserts that there are some macroeconomic factors that foster the development pattern of Bitcoin. Factors such as inflation pressure, interest rate expectations, and currency issues form the environment in which Bitcoin functions.

A lower inflation rate enhances investor confidence. When interest rates become stable or decrease, risky assets will perform well. Bitcoin responds to changes in global investor sentiment, and it responds quickly to any changes in the inflation rate.

The theory aside. How does it feel on the trail?

When the cost of borrowing goes down and the confidence level enhances, the markets take a breath. Bitcoin is quicker to react than traditional assets.

Institutional Demand and its Impact on Tom Lee's Bitcoin Forecast

Institutional investment has an important presence in the outlook given by Lee. Institutional investment in Bitcoin has received a boost from large funds and investment managers. Spot ETFs and financial products offered facilities to investment institutions that earlier stayed out of the cryptos sector.

Lee states that this structural change turns a niche asset into a generic investment class because the increase in capital allocation by institutions leads to stability in long-term demand:

This is why the number of bitcoin tom lee and tom lee on bitcoin inquiries is higher when new institutional data is released.

Why Tom Lee Says Bitcoin Volatility is a Good Sign

Volatility has a negative connotation to new traders. Lee has a different perspective regarding the issue. He believes that the presence of volatility indicates the active involvement of people in a market. The activity of traders expressing their views through buying and selling will make the marketplace a healthy one.

Volatility = activity.

The closer an asset is to maturity, the less volatile it becomes. The fact, according to Lee, that "Bitcoin is in the early days of global adoption" puts it in a position where large price movements are frequent occurrences.

Is Tom Lee's $200,000 Target Realistic?

Lee has spoken of the potential for the value of a Bitcoin to reach $200,000 in the right environment. The target sticks out because it appears lofty.

Is the target reasonable?

For Lee, the number represents mathematics more than imagination. If the number of demands grows in terms of ETFs, institutional investor take-up, and holding trends, the market will adjust to increase too. The lack of supply enhances the prediction.

Nonetheless, the achievement of $200,000 will require a very high alignment in the various dimensions of the macroeconomic environment. Users should consider the target more of a model scenario than a prediction with a timeline.

Tom Lee Outlook: What It Means for Retail Investors

The outlook from Lee is explanatory, and users don't need to rely on forecasts to understand the actions of Bitcoin. The context made available by his assertions is important because it reveals the driving forces behind the asset.

People tend to view his opinion as a message of confidence too. Other people find his ideas a launching point for their studies too. Bitcoin is a highly volatile asset class even to date. Every individual should form his own opinion regarding Bitcoin trading too.

Non-custodial services such as Noone Wallet assist the user in monitoring their assets while enabling the holder to maintain complete control of the keys. This aligns well with the long-term vision of Lee to maintain the ethos of Bitcoin regarding the importance of self-custody.

How Tom Lee's View Compares to Other Analysts

There are differing analyses of the future of Bitcoin by analysts. While some agree with Lee's positive prognosis, there are those who predict that the volatilities will first be experienced before anything significant happens.

For instance, people like Willy Woo analyze based on chain data. Then there are those who analyze based on macro signals, and examples include people like Mike McGlone. Others utilize conditions related to regulation and the concept of liquidity.

Lee tends to emphasize structural demand and long-term adoption trends. The view presented is one of a number in the discussion in the wider marketplace.

What are the possible risks?

Even the strongest theses are not immune to risks. Several risks are acknowledged by Lee to affect the momentum of Bitcoin.

The regulatory environment is another area of concern. Unanticipated changes in policies tend to trigger a rapid shift in market sentiments. Liquidity changes in the global markets also tend to affect the value of Bitcoin. Security issues and large-scale events tend to undermine confidence in the system.

Brief sentence. Clear warning: All forecasts involve risks.

By understanding the possible challenges, the expectations remain realistic.

Short-term vs Long-term Expectations of Bitcoin

Lee distinguishes short-term actions from long-term trends. Short-term price actions are unpredictable processes. They involve leverage, emotions, and fast action.

Long-term trends involve adoption, rarity, and technological advancement.

People tend to be confused regarding the timelines. They think long-term forecasts will be applicable for short-term periods. This is emphasized by Lee: The theory, however, aside. How is it out in the trail?

Short-term variations appear to be random. Long-term trends appear to be ordered.

If Tom Lee is right in his prediction, will Bitcoin rise?

All forecasts are potentially contestable based upon unanticipated events. Lee argues that "drastic regulatory constraints, severe liquidity problems, and macroeconomic events" might upset the course of Bitcoin. If institutional investment commitments wane, his long-term forecasts might need to be revised.

Forecasts are based upon assumptions. If assumptions vary, the results will vary too. This is for any forecaster, not only for Lee.

Understanding this aspect will enable users to utilize forecasts in a responsible manner.

Conclusion

Tom Lee is also one of the widely discussed analysts in the cryptospace to this day. The bitcoin Tom Lee outlook presents a positive outlook based on a deep understanding of the structure of the marketplace and economic trends. Though his forecasts make the headlines, they should be viewed through the lens of analytical hypotheses and not promises.

This article has discussed why Tom Lee is of the view that Bitcoin will again touch new highs, how the present scenario favors his outlook, and what might go against it. The article has also tried to present a well-rounded picture to the reader by comparing Tom Lee's view with that of other experts.

Those users of Bitcoin who handle the digital currency through non-custodial services such as Noone Wallet experience the advantages of transparency and oversight in the face of such long-term trends. Regardless of whether the prediction made by Lee proves to be correct in the long run, an insight into the logic behind the prediction allows users to understand the debates concerning the function of Bitcoin in the developing digital economy.