Super Micro Computer Inc (SMCI) — Price Prediction 2025–2040

Disclaimer: This article is for informational purposes only and is not financial advice. Investing in stocks carries risk and past performance does not guarantee future results. Always do your own research.

Overview

Introduction

Super Micro Computer (ticker: SMCI) designs and manufactures high-performance server and storage systems used in AI infrastructure, data centers, cloud and edge computing. The company is positioned to benefit from rising demand for AI training/inference hardware and large-scale data-center builds, but it also faces intense competition and execution risk.

Secure your Super Micro Computer Inc (SMCI) holdings with Noone Wallet — a trusted, non-custodial wallet offering freedom, simplicity, and complete crypto control.

What is Super Micro Computer (SMCI)?

- Founded: 1993 (headquartered in San Jose, CA).

- Business: Server systems, storage systems, modular blade servers, rack solutions for enterprise data centers, cloud providers, AI training/inference, telco/edge and HPC workloads.

- Key strengths: High-density, liquid-cooling server designs; partnerships with major chip vendors (e.g., NVIDIA); exposure to AI infrastructure spending.

- Key risks: Fierce competition (Dell, HPE, others), margin pressure, supply-chain constraints, execution and geopolitical/regulatory risk.

Price Prediction (2025 → 2040)

Year | Price prediction (USD) | ROI |

|---|---|---|

2025 | $75.00 | ~ +35% |

2027 | $65.00 | ~ +17% |

2030 | $110.00 | ~ +99% |

2035 | $180.00 | ~ +225% |

2040 | $300.00 | ~ +442% |

Notes on the forecast

- 2025 ($75): Near-term upside if AI server demand and new contracts accelerate and macro conditions remain supportive.

- 2027 ($65): More conservative — assumes cyclical slowdown, margin or supply-chain headwinds.

- 2030 ($110): Material share of AI infrastructure build-out, solidifying position in cloud/enterprise deployments.

- 2035 ($180): Continued adoption of AI/data-center hardware with margin expansion and competitive positioning.

- 2040 ($300): Bull case where SMCI is a leading infrastructure play within a much larger AI/data-center market.

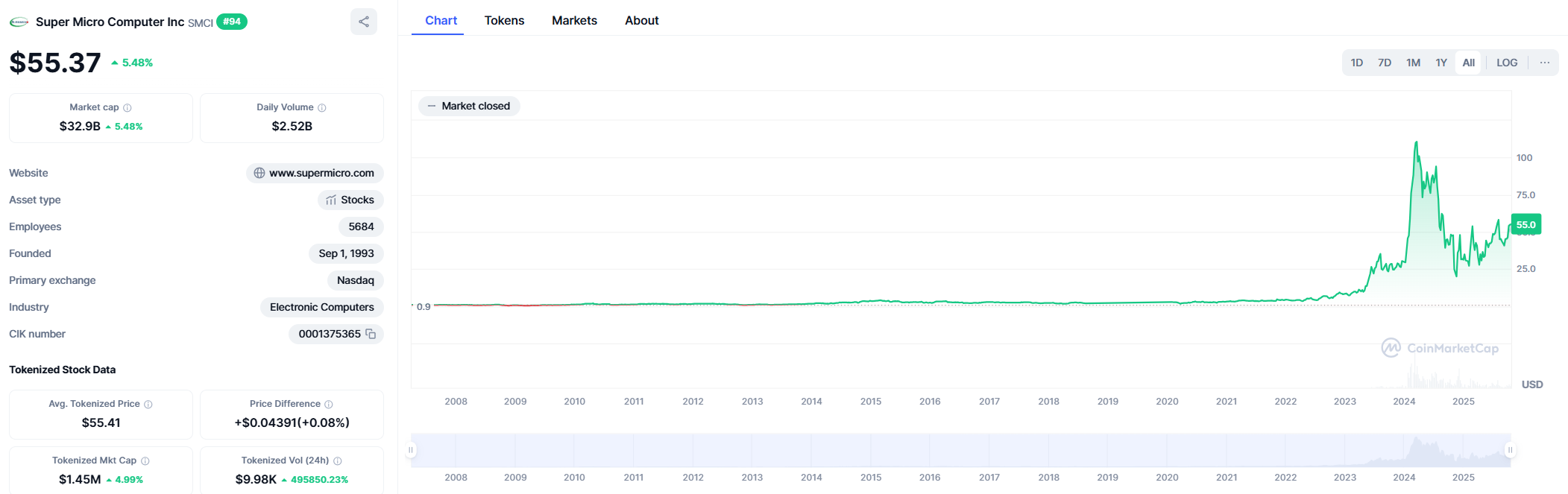

Historical price & milestones

Date / Period | Approx. price | Key event / reason |

|---|---|---|

Mid 2024 | ~$17.25 | 52-week low amid macro / margin concerns |

Early 2025 | ~$55–60 | AI server demand picks up; investor excitement |

Q4 FY2025 | ~$46–50 | Missed revenue & profit estimates; guidance cut |

Oct 2025 | ~$55.37 | Mixed optimism: thematic tailwinds vs execution risk |

SMCI’s price history reflects strong thematic sensitivity to AI demand and the company’s execution/earnings cadence.

Key drivers & risks

Primary drivers (upside catalysts)

- AI infrastructure demand: large-scale model training and inference hardware purchases.

- Data-center expansion: cloud providers and enterprise CAPEX for compute/storage.

- Technology differentiation: liquid-cooling, high-density systems, custom solutions.

- Strategic partnerships: relationships with chipset and OEM partners (e.g., NVIDIA).

Main risks (downside catalysts)

- Competition: Dell, HPE and other OEMs competing on price, scale and service.

- Margin pressure: component cost increases, pricing competition.

- Supply-chain & capacity constraints: limits on throughput or delayed deliveries.

- Execution & governance issues: missed guidance, quality problems or management missteps.

- Macro & geo risk: macroeconomic slowdowns, tariffs, export controls.

Sentiment & technical notes

- SMCI can exhibit high volatility driven by news (earnings, contracts, macro).

- Periods of high short interest may create squeeze dynamics during positive catalysts.

- Investors should watch TVL-style indicators for hardware (order backlog, bookings, guidance) and gross margin trends.

FAQ

Is SMCI a good investment?

Depends on your risk tolerance and conviction in long-term AI/data-center structural growth. SMCI is a high-growth, high-risk hardware play — suitable for speculative or growth-oriented investors who accept execution and cycle risk.

What might SMCI be worth in 10–15 years?

Under a moderate case SMCI could reach ~$110 by 2030 and ~$180 by 2035. In a strong bull case (dominant market share and margin expansion), the stock could approach $300 by 2040. These are scenario projections, not promises.

Should I buy SMCI today (at ~$55.37)?

Consider whether you believe SMCI will: (1) win meaningful AI/server contracts, (2) maintain/expand margins, and (3) execute operationally. Diversify and size positions to manage downside.

Can SMCI reach $500?

Yes, but that would be an extreme bull case requiring dominant share of a vastly larger AI/data-center market, strong margins, minimal dilution and benign macro conditions.

Conclusion

Super Micro Computer sits at the intersection of powerful secular trends — AI compute demand and data-center expansion — giving it significant upside potential. However, the opportunity comes with material execution, competition and macro risks. The scenario targets above (from $75 in 2025 to $300 in 2040) map conservative through bullish outcomes; investors should combine these scenarios with up-to-date financials, order/backlog data, and macro context before acting.

You can store, buy, exchange, send, and receive Super Micro Computer Inc (SMCI) securely with Noone Wallet — a non-custodial wallet that keeps your crypto completely under your control.