One of the more well-known oracle systems in crypto, the price of the Pyth Network's native cryptocurrency, PYTH, can be affected by the general crypto market as well as developments in the Pyth Network itself. If you're looking to store your PYTH and other assets in a non-custodial wallet where you have control over your assets, be sure to check out Noone Wallet when you need to store your assets between exchanges or when using a Web3 application.

The content of this article will cover what Pyth Network is, what impacts the price of the Pyth Network's cryptocurrency, PYTH, as well as how to think about a price prediction for the cryptocurrency. This content should not be taken as financial advice.

What is the Pyth Network?

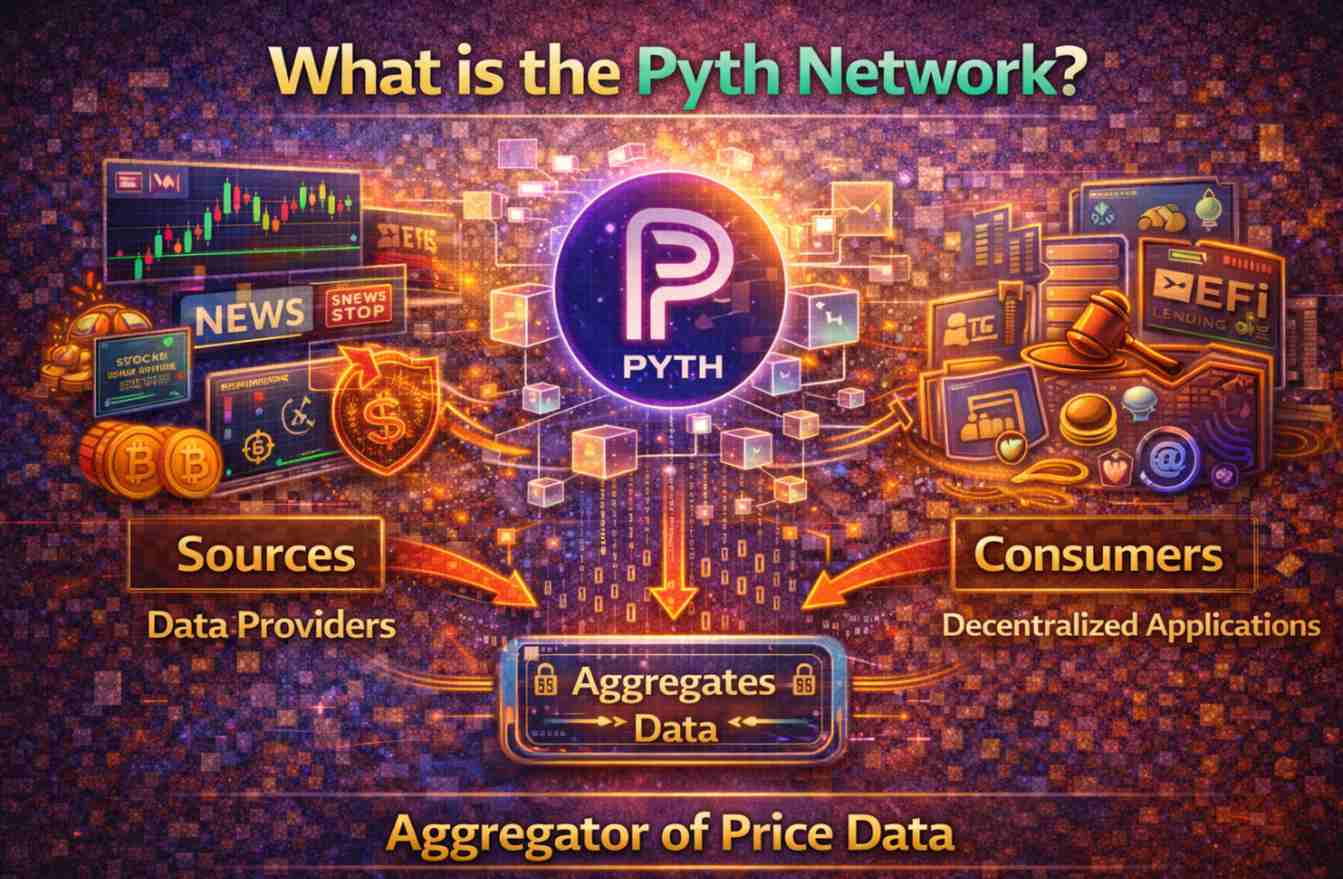

Before we dive into a price prediction for the cryptocurrency, it's important to understand what the Pyth Network is. Essentially, the Pyth Network is an oracle. An oracle is a way to bring data on-chain so that decentralized applications can utilize it in trading, lending, liquidations, valuation of assets held as collateral, and other functions that are dependent on current prices.

Essentially, the way it works is that there are publishers of data, which are the sources of the data. Then there's the oracle itself, which aggregates the data into a single price. Then there are the consumers of the data. This way, it's not just a single source of data, it's multiple sources of data.

Pyth's product is a collection of price feeds that applications can use, which can be integrated across many chains. Publishers provide the pricing information, the oracle program aggregates the information, and the consumer uses the information provided by the oracle program. One of the concepts that is used in most of the integrations is the concept of a pull oracle, which is part of the Pyth product. In the concept of a pull oracle, the price is updated at any time, not at a predetermined time, by any person, and the update is verified by the smart contract. This is important because, in the concept of a pull oracle, the update happens at any time, not at a predetermined time, which is beneficial because the update happens as frequently as possible, up to 400 milliseconds, according to the information provided by the Pyth organization.

PYTH Price Chart

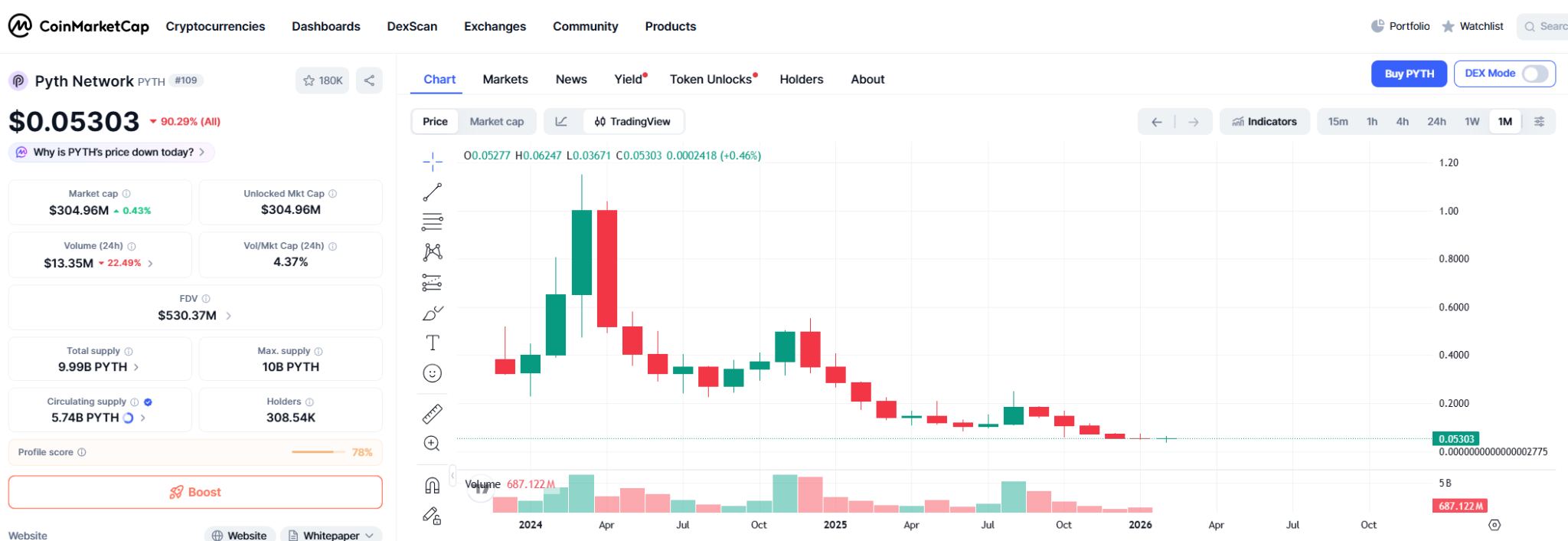

When someone is searching for the pyth network token price, the person is looking to know the current price, the trend, and the liquidity of the token, at least in most cases. Currently, as of Feb 20, 2026, the token is priced at $0.053, with a 24h volume of $13M, circulating supply of 5.75B, and a total supply of 10B, according to CoinGecko.

When looking at the price chart, the price of the token is typical of most altcoins in a weak to mixed market, with large moves in the token's price, large moves in the token's price in reaction to announcements, and large moves in the token's price in reaction to changes in liquidity. Because of the large moves in the token's price, any pyth network token price prediction will need to be in terms of scenarios, not a target.

Pyth Network (PYTH) Price History Highlights

When looking at the history of the token, any predictions of the price in the near future will need to be based on the history of the token's price in order to understand the potential range of the token's price in the near future. According to CoinGecko, the all-time high is $1.20, while the all-time low is at $0.037.

It also helps to keep in mind that PYTH has a large total supply (10B) and meaningful unlock dynamics, so it's worth keeping in mind that "price per token" isn't necessarily as meaningful without also considering market cap. Two projects can have similar tech-level impacts but vastly different prices simply because of differing circulating supply.

PYTH Price Prediction 2026

A reasonable Pyth Network price prediction 2026 must take into consideration two factors that are working against each other. The first factor is that Pyth can increase adoption as more and more protocols utilize Pyth's chain agnostic feeds, and the pull-oracle mechanism could be attractive to applications that need fresh prices on-demand. The second factor is that supply dynamics do matter. Pyth's own tokenomics state that 85% of PYTH was originally locked, and that unlocks happen every 6, 18, 30, and 42 months after the initial token launch. Scenario possibilities (not a prediction, just examples):

• Bear Case (Risk-Off & Sell-Off): $0.03 - $0.06

• Base Case (Gradual Adoption & Neutral Market): $0.06 - $0.12

• Bull Case (Strong Market Cycles & Clear Adoption): $0.12 - $0.25

The price prediction possibilities are wide because we know that PYTH has shown large percentage swings during past market cycles.

Pyth Network Price Prediction 2030

In 2030, it's less about predicting price movements and more about how Pyth fares as part of the larger DeFi ecosystem. If Pyth continues to be used as a tool for high-frequency price-sensitive applications, then it's possible that there's continued strength in the need for reliable low-latency price feeds, and governance could potentially be more important as it evolves.

But competition is real. We compete on security assumptions, latency, feed coverage, chain availability, and dev experience. A price prediction for the year 2030 for the pyth network needs to be based on adoption metrics, not narratives.

Scenario ranges (Illustrative):

• Bear case: ~$0.05 to $0.20

• Base case: ~$0.20 to $0.60

• Bull case: ~$0.60 to $1.20

One way to sanity-check the ranges above is to try to estimate them in terms of market cap, using the circulating supply at the time, not the circulating supply today.

PYTH Price Prediction 2040

In a price prediction for the year 2040, you're actually making a prediction about the importance of decentralized market data in a much, much more developed on-chain economy. If on-chain finance continues to expand to cover more asset classes (FX, commodities, equities-style exposure), then oracle infrastructure becomes potentially much more "utility-like," and the winners are those that remain trusted and integrated.

But token economics can change the game in the long term. As the supply unlocks move towards the 10B total supply, the same market cap can actually result in a lower price for each token than in earlier years, so long-term price prediction needs to account for the distinction between "network value" and "token price."

Scenario ranges (Illustrative):

• Bear case: ~$0.15 to $0.60

• Base case: ~$0.60 to $2.00

• Bull case: ~$2.00 to $4.00

These, of course, assume that Pyth will remain relevant over many cycles, which is a huge assumption in crypto and should be viewed with caution.

PYTH Price Prediction 2050

The premise of a price prediction of the Pyth Network in 2050 is, by its nature, highly speculative since it assumes the continued viability of the project and the crypto space in general. The best argument for a continued viability of the project is that data in the markets is a fundamental human need, and oracle systems that are reliable and well-governed can ensure their continued place in the stack.

The best argument for a lack of confidence in a continued viability of the project in 10+ years is that technology, regulation, and markets can change dramatically, and long-term token performance can decouple from product performance. This means that while the product itself may be successful, the value capture of the PYTH token itself is what's important to token holders.

Scenario ranges:

• Bear case: $0.25-$1.00

• Base case: $1.00-$5.00

• Bull case: $5.00+

Any numbers discussed above should be considered a thought experiment rather than a prediction.

PYTH USDT Price Technical Analysis

The PYTH/USDT pair is a common trading pair on large exchanges. Technical analysis of a cryptocurrency's price does not predict the future; rather, it can be a way to structure risk by understanding where traders have acted in the past.

A basic framework for analyzing the PYTH/USDT pair:

• Trend: Is the price above or below key moving averages on the daily/weekly charts?

• Momentum: While not super effective on its own, it can be a useful indicator when cross-referenced.

• Support/Resistance: While important, these are less relevant than prior consolidation.

• Volume: Increasing or decreasing volume on a breakout or pullback can be a sign of a healthy or unhealthy trend.

Given that PYTH has shown high volatility and large drawdowns, it's more important to focus on position sizing and invalidation rather than trying to "call the exact bottom."

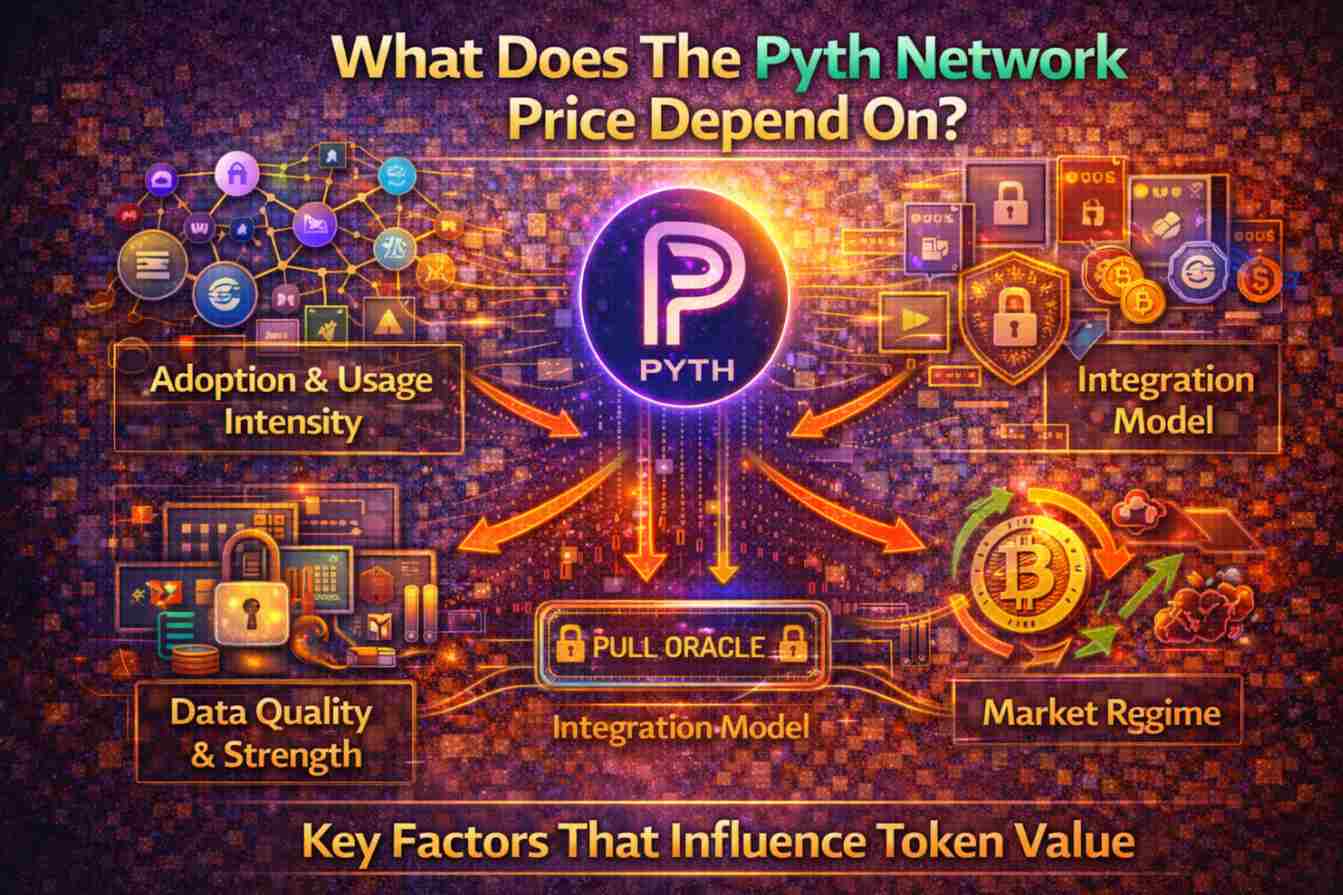

What Does The Pyth Network Price Depend On?

For a more grounded approach to "what does the pyth network token price depend on," we can focus on factors that are quantifiable:

1. Adoption and usage intensity: How many projects rely on Pyth network feeds, and how price-sensitive are these projects?

2. Data quality and strength: More publishers per product can help build trust in these price feeds.

3. Integration model: Pull-oracle model can help reduce unnecessary update costs while providing access to fresher prices when needed.

4. Token supply: Unlock schedules and supply can help create selling pressure or alter optics on valuation.

5. Market regime: Market liquidity, risk-on/risk-off, and Bitcoin's cycle can often dominate altcoin performance in the near- and medium-term.

Pyth Network Token Unlocks

Token unlocks can also be one of the most important fundamental factors to keep an eye on related to PYTH, as it affects supply. The official Pyth website indicates that the max supply of Pyth Network Token is 10B, with an initial circulating supply of 1.5B or 15% of max supply. The official website also indicates that these tokens are locked and start to unlock after 6 months, 18 months, 30 months, and 42 months after the initial launch of Pyth Network Token.

Third-party trackers that show Pyth Network Token vesting schedules also show that there's a "next unlock" event that can be estimated based on this data. For example, DropsTab indicates that there's a next unlocking event of 2.13B PYTH, or 21.25% of the total supply, and indicates that there may be imperfections with this data.

How it relates to a pyth network price prediction:

• Unlocks increase the supply, which may drive the price down if the demand does not increase at the same time.

• Markets may price in known unlock events, but the reaction may be quite sharp in any case.

• Over the longer term, what matters is the growth in adoption compared to the growth in supply.

Pyth Network Community

Pyth Network's community development is directly related to the number of integrations and the direction in which the organization is moving. One piece of notable community development was the retrospective airdrop program, which was meant to reward contributors and users across a wide array of blockchains and applications. This was meant to encourage the wider community to participate in the decision-making process.

The posts on the airdrop also demonstrate the organization's view on what it means to be decentralized and how it impacts the wider community. It encourages users and applications that use the organization's data and warns users about scams and the need to be safe. This impacts the wider community and, in turn, the price of the pyth network token indirectly.

Pyth Network Price Prediction: Questions and Answers

1) What is Pyth Network in simple terms?

What is Pyth Network? It is a blockchain-based on-chain oracle protocol that publishes market prices. This enables smart contracts to use the prices for DeFi operations in a safe manner.

2) Why does PYTH have a confidence interval in its feeds?

This information is aggregated in terms of a price, along with a confidence interval that is used to represent the level of uncertainty in the given information, which is helpful in determining whether the price is good enough to be used by applications.

3) Is a pyth network price prediction reliable?

Any given pyth network price prediction is not entirely reliable because there is a level of uncertainty that is present in the prediction, given that there are factors like market cycles that affect the price of the tokens.

4) How do token unlocks affect the pyth network token price?

Token unlocks can affect the token price because of the increased level of circulating tokens, which might not be met by the demand, thus affecting the token price negatively, given that there is no increased demand to match the increased token supply, as explained in the tokenomics of the pyth network, which clearly explains the token unlocks that will take place after the initial token launch.

5) What is the current pyth token price, and what is the current circulating token supply?

Based on the information retrieved from CoinGecko, the current pyth token price is approximately $0.053, while the circulating token supply is approximately 5.75B, with the total token supply being 10B, as of Feb 20, 2026.

Conclusion

To make a good pyth network price prediction, one must begin by understanding what pyth is, what the pull oracle model is, and the token supply, as these factors are fundamental in understanding the pyth token price, thus helping one to have a better understanding of the token price without being misled by hype that is usually associated with the pyth token price.