Jupiter (JUP) — Price Prediction 2025–2040

Note (Disclaimer)

This analysis is informational only and not investment advice. Always perform your own research before making investment decisions. Cryptocurrency markets are volatile.

Introduction

Jupiter (JUP) is a Solana-based project that gained attention for its swap aggregation engine and expanding DeFi feature set. Traders and investors commonly ask: What could JUP be worth in 2025, 2030, or 2040? Can JUP become a core liquidity layer for Solana?

This report reviews Jupiter’s purpose, tokenomics, historical price action, and delivers scenario-style price estimates for 2025–2040.

Tip: Buy, store and exchange JUP safely with Noone Wallet— a non-custodial wallet that gives you full control of your keys and supports 1,000+ assets across multiple blockchains.

What is Jupiter (JUP)?

Jupiter is a decentralized exchange (DEX) aggregator on Solana. Its primary goal is to find the best swap routes by scanning liquidity across Solana DEXes, effectively acting as a routing engine that gives traders optimal rates.

Core product evolution

- Liquidity routing / aggregation — best-rate swaps across Solana liquidity sources.

- Expanded services — perpetual markets, limit orders, dollar-cost averaging (DCA), and a token launchpad.

- JUP token (launched early 2024) — governance + utility token enabling participation in protocol decisions and ecosystem benefits.

Circulating supply: ~1.35 billion JUP

Price Predictions (2025–2040)

Jupiter’s future price depends on: Solana ecosystem health, adoption of Jupiter’s tools, and the broader DeFi market cycle. Below are scenario-style estimates based on those factors.

Year-by-year scenario summary

- 2025: Moderate growth as Solana DeFi activity increases → $0.85 (Estimated ROI: +93.5%)

- 2027: Post-cycle consolidation → $0.70 (Estimated ROI: +59.3%)

- 2030: Widespread adoption of cross-chain and on-chain trading solutions → $2.80 (Estimated ROI: +537.3%)

- 2035: DeFi mainstreaming and cross-chain liquidity becomes fundamental → $5.60 (Estimated ROI: +1,174%)

- 2040: Bull case with global adoption and sustained innovation → $9.50 (Estimated ROI: +2,062%)

Jupiter Price Prediction — Table

Year | Price prediction (USD) | Estimated ROI (if bought at $0.4396) |

|---|---|---|

2025 | $0.85 | +93.5% |

2027 | $0.70 | +59.3% |

2030 | $2.80 | +537.3% |

2035 | $5.60 | +1,174% |

2040 | $9.50 | +2,062% |

Narrative for each target

2025 — Short term: $0.85 (+93.5%)

Continued Solana DeFi development and stronger positioning as a liquidity hub could push JUP toward ~$0.85 by end-of-2025 (roughly double the reference price).

2027 — Consolidation: $0.70 (+59.3%)

A typical post-cycle correction may follow the 2026–2027 period. If Jupiter and Solana remain operationally sound, JUP could stabilize around $0.70.

2030 — Broader adoption: $2.80 (+537.3%)

If Jupiter becomes a fundamental routing and cross-chain liquidity layer for on-chain trading, broader adoption could drive JUP toward $2.80.

2035 — Mainstream DeFi: $5.60 (+1,174%)

Assuming DeFi becomes widely used and Jupiter retains or grows its market share in liquidity aggregation, $5.60 is a reasonable long-term target under sustained growth.

2040 — Bull case: $9.50 (+2,062%)

In a best-case scenario where Jupiter remains innovative, Solana remains relevant, and cross-chain liquidity use is ubiquitous, JUP could reach roughly $9.50 — acknowledging high uncertainty at such horizons.

Jupiter (JUP) — Historical Price Analysis

A concise timeline of notable price points and catalysts:

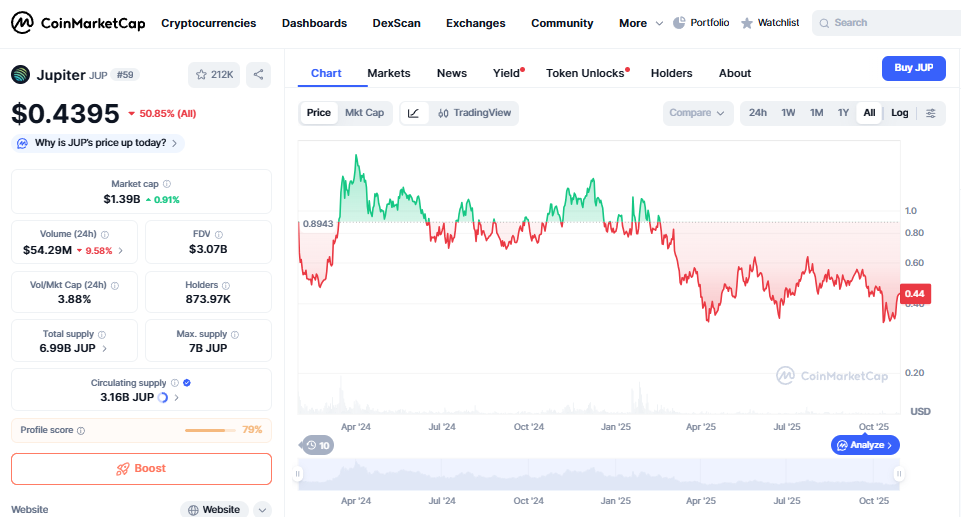

Date | Price | Event / Reason |

|---|---|---|

Jan 31, 2024 | $0.65 | Token launch after anticipated airdrops; initial hype and high volume |

Feb 7, 2024 | $0.52 | Early profit-taking and post-launch stabilization |

Mar 10, 2024 | $0.38 | DeFi correction and reduced Solana DEX activity |

Apr 22, 2024 | $0.47 | Recovery after announcement of perpetual trading |

Jun 5, 2024 | $0.63 | Increased on-chain transactions and optimism for Solana trading tools |

Aug 14, 2024 | $0.80 | Speculative rally after new integrations and better liquidity |

Dec 29, 2024 | $0.41 | Market-wide correction ahead of Bitcoin halving |

Mar 25, 2025 | $0.50 | Renewed confidence as Solana outperformed in throughput |

Jun 17, 2025 | $0.46 | Consolidation period with less speculative buying |

Oct 28, 2025 | $0.4396 | Current price at time of this report |

Summary: In its first years JUP moved from an airdrop/hype token to a core liquidity provider for Solana DeFi. Volatility is present, but Jupiter sustained reasonable trading volume compared to many newer DeFi tokens.

FAQs

Is Jupiter (JUP) a good investment?

Jupiter plays an important role within Solana DeFi. Its fundamentals depend heavily on Solana’s ecosystem health. As always, investments in crypto carry risk — do your own due diligence.

What might JUP be worth in 10 years?

Under reasonable adoption scenarios, JUP could be trading near $5.60 by 2035, assuming Jupiter remains a leading liquidity aggregator and Solana retains market relevance.

Should I invest in JUP now?

At the reference price (~$0.4396), JUP shows upside potential relative to earlier highs but remains exposed to protocol, network, and macro risks. Decide based on your risk profile and research.

Who built Jupiter?

Jupiter originated from contributors within the Solana ecosystem (early development involved the pseudonymous developer commonly referred to as “Meow”) and follows a community-oriented governance model.

What makes Jupiter unique?

Best-rate routing across Solana DEXes, plus expanding features (perpetuals, limit orders, DCA, launchpad) that position it as a multi-tool for on-chain trading.

How can I store JUP safely?

Store JUP in a secure non-custodial wallet such as Noone Wallet, which supports Solana tokens and enables you to keep control of your private keys.

Conclusion

Jupiter (JUP) has carved a notable niche in the Solana DeFi landscape as a liquidity aggregator and trading infrastructure provider. Its future price depends on Solana’s broader adoption, Jupiter’s ability to expand services and liquidity, and overall market cycles. The table above offers scenario targets from conservative to bullish — treat them as illustrative, not guaranteed outcomes. Always diversify, manage risk, and keep close to protocol developments.

Manage JUP and other cryptocurrencies easily with Noone Wallet — a secure, non-custodial solution for storing, exchanging, and tracking your crypto assets.

Sources: CoinMarketCap, Cointelegraph, Decrypt, Solana Foundation reports, Jupiter documentation.