Is XRP a Stablecoin? What You Need to Know

A stablecoin is a type of cryptocurrency designed to keep its value as stable as possible.

In most cases, this stability is achieved by pegging the token to a fiat currency such as the US dollar or the euro.

How does this work in practice?

Issuers typically hold reserves that match the total supply of tokens in circulation. These reserves may include cash, bank deposits, or short-term government bonds. In theory, one token should always be redeemable for one unit of the underlying currency. If the price drifts away from the peg, arbitrage and redemption mechanisms are used to bring it back in line.

There are several common models of stablecoins:

• Fiat-backed stablecoins like USDT

• Crypto-backed stablecoins secured by other digital assets

• Algorithmic stablecoins that rely on code and economic incentives rather than direct reserves

When people talk about a “stablecoin,” they usually mean a digital asset designed to stay close to a fixed value, such as 1.00 USD.

But not all widely used cryptocurrencies are meant to be stable.

XRP, for example, is not a stablecoin. Its value is market-driven, yet it plays a different role in the crypto ecosystem. XRP is often used as a fast and efficient bridge asset for transferring value across borders, rather than as a price-stable store of value.

This distinction is important. While stablecoins aim to minimize volatility, assets like XRP focus on speed, liquidity, and low transaction costs — which is why XRP is commonly used for payments and transfers and can be stored, sent, and managed in wallets such as Noone Wallet, alongside stablecoins and other cryptocurrencies.

So where stablecoins offer predictability, XRP adds flexibility and utility — completing the picture rather than replacing it.

__________________________________________

What Is XRP and How Does It Work?

XRP is the official digital currency of the XRP Ledger blockchain, a public blockchain designed for faster and less expensive global payments than those facilitated through traditional banking systems.

Instead of a proof-of-work system, the XRP Ledger has a consensus algorithm involving validators. Validators validate transactions and maintain the integrity of the network. Blocks are not “mined” but verified in a matter of seconds with the lowest possible transaction costs.

Key points about XRP:

- It is used to move value across borders quickly

- It can serve as a bridge asset between different fiat currencies

- The supply of XRP is fixed and was created at launch

- Transactions are fast and relatively low cost

Generally, XRP falls in the category of an altcoin, an “alternative cryptocurrency to Bitcoin.” Consequently, if one simply has to answer the question “is xrp a altcoin,” the answer will be affirmative because it stands out as another project altogether.

Which people are really using the XRP?

Each of the following has a different interaction with XRP: payment institutions, remittance services, traders, and ordinary users. While some of them utilize the coin for the purpose of transferring liquidity across borders, others trade it in the form of a speculative asset through exchanges.

__________________________________________

Why Do Some People Call XRP a Stablecoin?

If XRP is indeed an altcoin, why are people asking "Is xrp a stablecoin?" There are a number of reasons why people will be confused regarding this question.

First of all, the existence of XRP quite commonly relates to global payments and banking systems in popular discussion. Various people relate such an application to stablecoins because the purpose of both of them is to enhance the speed and efficiency of money transfers.

Secondly, the fact that the value of XRP might be less volatile than some other altcoins, and indeed some altcoins that in turn are less volatile than Bitcoin, means that it “looks” less volatile to a new observer and thus “Ripple StableCoin.”

Thirdly, marketing and headlines will sometimes get the terms mixed up. If a person hears that a bank is transferring value with the help of XRP, they might believe that it functions in the same way a USDT and a USDC work.

So the question “is xrp a stablecoin” usually comes from:

- Comparing its role in payments to that of stablecoins

- Seeing it mentioned in banking or remittance contexts

- Misunderstanding how its price behaves

Theory aside. Let us look at the key differences.

________________________________

XRP vs Stablecoins: Understanding the Basics

For a better understanding, a comparison of XRP to traditional stablecoins will be made.

- Price behavior

- Peg and reserves

- Primary use case

- Risk profile

"Is xrp a stock or a stable coin?" Well, if you are wondering the same thing, the answer is "no." It is a cryptocurrency and functions as a payment vehicle based upon a certain blockchain, but it has a floating exchange rate, meaning it is not fixed to anything.

Just what is the overriding message?

The application of XRP is similar to stablecoins, but the structure and associated risks tend to be quite different.

__________________________________________

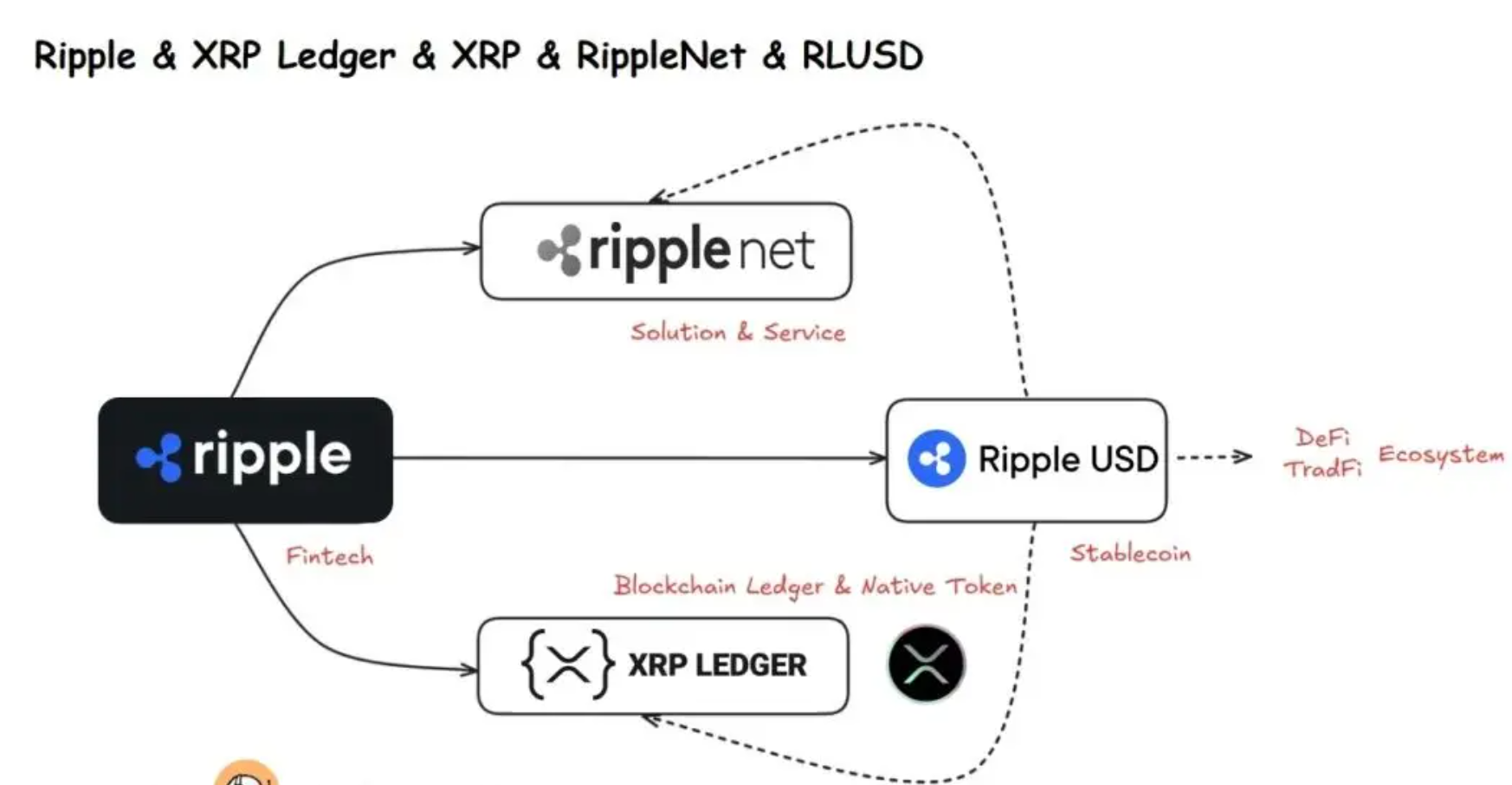

Does Ripple Have a Stablecoin? (RLUSD Explained)

Though the XRP coin is not a stable one, the company associated with the coin, Ripple, has been involved in another stable coin named RLUSD (Ripple USD) based on the value of the USD.

RLUSD is designed to be:

- Backed by reserves such as cash and short-term US government securities

- Issued on the XRP Ledger and other chains, so it can move across networks

- Pegged to 1 US dollar, like other fiat-backed stablecoins

“Ripple stablecoin” suddenly finds its place in this context. RLUSD will be the actual stablecoin within the Ripple environment, while the purpose of XRP will be to serve as a freely tradable asset within the marketplace.

So:

- XRP - native token of the XRP Ledger, volatile, used for liquidity and payments.

- RLUSD - USD-pegged stablecoin issued by Ripple, designed to stay close to 1 USD.

If you want something with a stable value in the Ripple ecosystem, the stable coin is RLUSD, not XRP."

__________________________________________

What This Means for You as an Investor

For an investor, treating the XRP in an identical manner to a stable coin might give rise to misconceptions.

If you think the value of XRP will fluctuate in the same way that a digital cash system functions in a 1:1 manner, you will be surprised at the price action because it doesn’t function in the same way that stablecoins do, in terms of pegs and reserves.

Here are a few simple points:

- XRP is an altcoin with utility in payments, not a digital dollar

- Stablecoins are tools for stability and on/off ramps, not usually speculative assets

- You might use both in your portfolio, but for different purposes

For instance, an individual may hold a stable coin for the purpose of parking funds between trades, while another individual holds the XRP coin for the purpose of conducting fund transfers across exchanges and speculation regarding the long-term adoption of the XRP Ledger.

Whether xrp is a stock?

No. It is not a representation of equity ownership in Ripple or in any company for that matter. It is a digital asset.

Whether xrp should be considered an alt coin to keep an?

This is contingent upon your own investigation, the levels of risks involved, and your perception of its possible utilization in the payment processes of the future.

Sounds complex? Let’s move to the kinds of questions people commonly ask.

__________________________________________

FAQ About XRP and Stablecoins

Is XRP a stablecoin or an altcoin?

XRP is an altcoin. It is a cryptocurrency with a floating price, used on the XRP Ledger. It is not pegged to the US dollar or any other fiat currency, so it does not qualify as a stablecoin.

Why do people keep asking “is xrp a stablecoin”?

Because XRP is often mentioned in the context of cross-border payments and banking, many people instinctively place it in the same bucket as stablecoins. In reality, its design, price behavior, and risk profile are different.

Who is using XRP right now?

If you ask “who is using xrp,” the list includes payment companies, remittance services, liquidity providers, traders, and individual users. Some entities use XRP to move value between currencies. Others use it for trading or as part of a broader crypto strategy.

Is there such a thing as a “ripple stablecoin”?

Yes and no. XRP itself is not a stablecoin. However, Ripple is working with a USD-backed stablecoin project such as RLUSD, which would be a real stablecoin on the XRP Ledger and possibly other chains.

Can I use XRP the same way I use USDT or USDC?

You can use all of them for transfers, but they behave differently. USDT and USDC are designed to keep a stable 1 USD value. XRP can gain or lose value over time, so holding it carries more market risk.

__________________________________________

Do I Need to Pay Taxes on XRP?

The rules regarding tax vary according to the country where you live, but in many countries:

- Buying XRP with fiat is not taxed immediately, but

- Selling XRP for fiat, swapping it for another coin, or using it to pay for goods and services can be a taxable event

The category to which XRP has been assigned in certain countries is that of property and capital assets. altcoins and stablecoins are also sources of taxation when a user trades, sells, and spends the funds.

A few basic points:

- Keep records of purchases, sales, and swaps

- Track dates, amounts, and prices

- Consult a qualified tax professional in your country

So, do you need to pay taxes to XRP? Well, quite frequently, yes, but this will depend upon the laws in your country. It is best to clear this up right instead of dealing with problems later on.

__________________________________________

Conclusion

Whether XRP is a stable coin:

No. It is an altcoin designed for a particular purpose in making fast and cheap payments in the XRP Ledger system. The price is determined by the marketplace and is not pegged to any fiat currency in a 1:1 exchange rate.

Stable currencies such as USDT, USDC, and RLUSD function to maintain a value close to the value of 1 USD through reserves and redemption lines, while the value of XRP will fluctuate due to its typical properties of a cryptocurrency.

If you remember only three things, they should be the following:

- XRP is an altcoin, not a stablecoin or a stock.

- Stablecoins and XRP can work side by side but serve different purposes.

- Taxes, risk, and use cases differ, so it is worth understanding each asset before you use it.

With this simple picture in mind, you can read future headlines about XRP, ripple stablecoin projects, and RLUSD with much more confidence and far less confusion.