Is It a Good Time to Buy Bitcoin Right Now?

Bitcoin brings out the same question in both newcomers and those who are quite experienced in the matter: "Is it a good time to buy Bitcoin?" People view the current trends in the bitcoin market and question whether it is the right time to make a purchase. Others fear that the values might go lower in the future. Lots of people query "is now a good time to buy bitcoin 2025."

This article provides a clear and understandable explanation of the issue at hand. It doesn't contain any hype and any sort of investment advice but instead dissects the elements responsible for decision-making and the corresponding risks and emotions involved in such decisions in terms of the current perspective involving Bitcoin.

Bitcoin is available in the majority of Web3 wallets, such as non-custodial wallets such as Noone Wallet, where users are able to securely store, send, and manage their assets while having full control of their private keys. Such tools will enable users to monitor changes in the market efficiently while formulating strategies based on the changes.

When is the best time to buy Bitcoin?

There is no generic solution to the question because people will be working towards their own objectives. "Good" periods will mean a low point, a zone of consolidation, and a period in which the confidence in the marketplace is turning around in different instances.

Traditionally, Bitcoin has always operated based on a cycle that is triggered by events such as halvings and economic conditions. The price tends to go up and down and even stabilize before going up again.

The question is how this process works based on the supply schedule and the increase in the level of demand. All goods and services in the

The basic concept is simple: a good time depends on the user's strategy and volatilities he is willing to withstand.

How are the current Bitcoin price movements influenced?

Several factors are driving the price of Bitcoin in early 2025:

- Market liquidity

- Sentiment from institutional investors

- Regulatory signals

- Macroe

- The aftermath of the most recent Bitcoin halving

- Total Risk Appetite in the global markets

These are the elements that affect buying pressure and selling pressure in the marketplace. The higher the liquidity and confidence, the higher the stock price will be. The higher the fear and economic uncertainty, the lower the stock price will be.

"Sounds complex?" Let's take a look at an example. One economic report and a decision regarding a policy can move the entire cryptospace in a matter of hours.

Why is the Bitcoin price getting smashed?

During the period of correction, the question people mostly ask is whether it is the right time to purchase bitcoin now or why bitcoin is falling today. Bitcoin falls significantly due to leverage and liquidations in the markets.

When large leverage positions are unwound, forced sale pressure leads to a fall in prices, and negative news hastens this process. When there is a lack of liquidity, the price fall accelerates. Even if the fundamentals are strong, adverse short-term conditions will trigger a fall in stock prices.

The thing to remember here is that the drops are a normal phenomenon in the life of Bitcoin. Every growth phase of Bitcoin has experienced sharp correction phases in the past.

The important point is that drops are part of Bitcoin’s normal behavior. Bitcoin has experienced steep corrections in every growth cycle.

What is driving the gold and Bitcoin price to a record peak?

Gold and Bitcoin tend to be affected by the same macromeconomic impulses. For example, if inflation concern increases, if currencies fall in value, if political stability declines, then alternate sources of value are sought.

The scarcity factor in Bitcoin makes it appealing in such a period. Gold also has similar advantages in the environment. The rise of both together shows that the investor is looking for a shield against uncertainty.

The supply schedule of Bitcoin contributes to this phenomenon too. Since the rate of circulated supply growth slows down with the passage of time, the focus is shifted to long-term scarcity.

Impact of Market Sentiment: Buying Decisions in Bitcoin

Sentiment influences people's actions more than anything else in the market. When people are feeling upbeat, they will buy in the marketplace much more aggressively than if they are feeling uncertain.

Sentiment is affected by:

- News headlines

- Analyst

- Social media forums

- Institutional adoption

- Volatility in the

Theory theory theory. How is the experience in the bush? Having a positive news story will instantly boost confidence, even if nothing has changed in terms of fundamentals at the time.

Do you consider buying Bitcoin presently?

"Is it a good time to buy bitcoin today, is it a good time to buy bitcoin right now, or is this a good time to buy bitcoin?" This question is present in every corner. The correct answer to this question is that it depends upon the individual because bitcoin suits some strategies and doesn't suit others.

For some people, dips mean opportunities, while for others, the best course is to wait until the levels of volatility are stabilized.

The choice of the user should be dependent upon their own personal financial constraints and comfort levels in terms of risks taken.

All the information in this article is for educational and illustration purposes only and should in no way be considered investment advice.

Why buying Bitcoin might not be the right decision for you

Bitcoin is not for everyone. There are a number of reasons for this:

- Price variations can be worrying

- Some people favor assets with known return profiles

- Beginners might be discouraged by short-term drops

- Long term investment demands patience

- Learn basic security practices for a wallet

If an individual has reservations concerning a high level of volatility, it might be that Bitcoin is not a suitable choice for the individual's objectives.

New Investors: What risks to consider before purchase:

Various risks are associated with Bitcoin:

- Market volatility

- Changes in the

- Liquidity

- Security obligations in the use of non-custodial wallets

- Possible short term drawdowns

New users need to understand how wallets function, where to store their private keys, and how the market cycles work. The Noone Wallet allows users full control of their funds, but personal security practices are essential too.

Longer-term trends versus short-term fluctuations in value for Bitcoin

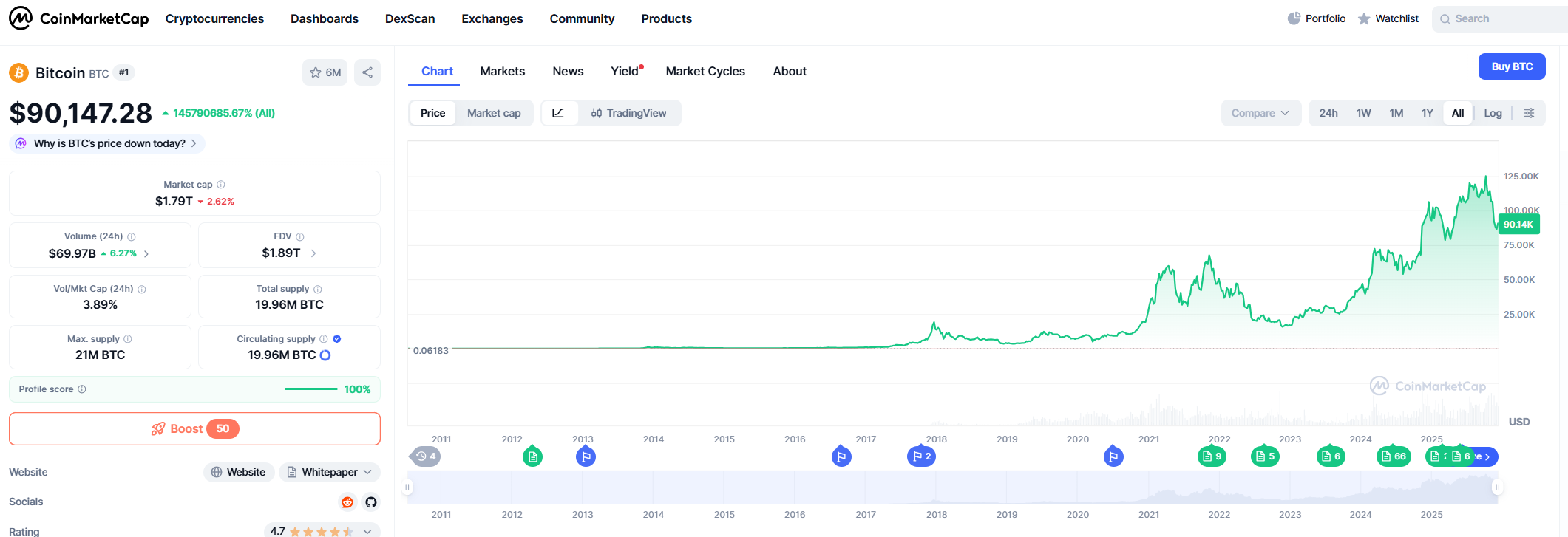

The short-term price variability sometimes leads to misunderstandings. The prices fluctuate considerably in a matter of hours. The long-term graphical representation reveals a totally different pattern. Bitcoin has been following a number of trends and corretions in the last number of years.

The long-term pattern includes the following:

- Increasing adoption

- More institutional participation

- Hard capped supply

- Market cycles based on halving events

The short term variations don't affect the overall forces acting in the long run. The short term variations produce noise while the long term trends form structure.

Well, what's the point to remember? People tend to misjudge short-term trends and long-term trends.

How analysts rate the purchase of Bitcoin in the current marketplace

Various views are presented by analysts. While some think that Bitcoin is in a long-term bull run based on the halving pattern, others think there will be more volatile periods in the coming years to attain stability again.

Renowned analysts like Mike McGlone, Willy Woo, and Tom Lee tend to examine the macro environment and the flow of liquidity to draw inferences.

There is a widely accepted view among most analysts regarding one thing: The long-term performance for Bitcoin is based upon adoption levels and supply dynamics. The short-term forecasts will be different, but the long-term trends will be the same.

How to Determine if Bitcoin Meets Your Strategy

The decision to include Bitcoin in an investment strategy involves the following personal assessments:

- Their time horizon

- Their tolerance for volatility

- Their need for liquidity

- Their comfort with self custody

- Their belief in bitcoin long-term model

There are traders who favor the cumulative process while awaiting the entry points in price levels. Having a clear action plan eliminates emotional trading decisions.

Conclusion

"So, should one buy Bitcoin right now? The answer has nothing to do with the market and everything to do with the individual." Bitcoin's cycles will repeat, its scarcity is constant, and its growth in adoption will just keep on expanding.

Once there is an understanding of the context and the fundamentals of the marketplace and the project, a knowledgeable investor will be able to make informed decisions based solely upon their investment objectives and

The implication in this article is that the choice of when to make a cell phone payment depends on a variety of factors but should ultimately be made by the consumer, because they know their needs best and should thus make decisions based upon their comfort levels.

This means that each and every individual should assess their objectives

The users who own Bitcoin are able to handle their assets through the availability of non-custodial services such as Noone Wallet, which allows the users to gain complete control over their keys and access a variety of assets that number in the thousands. This will enable the users to be flexible in their dealings because of the changes in the markets and their strategies in the long run.