COTI Price Prediction 2025–2040

Disclaimer: This article is purely for academia. It is not financial advice. Always do your own research before making any investments.

Introduction

This is a COTI price prediction article. Is COTI worthwhile to watch in the years 2025, 2027, 2030, 2035, and 2040? What would the price be then, and what ROI would an investor get if they invest today? In the paragraphs that follow we provide a rational prediction, a simple ROI estimate for each target year, as well as a summary of the price action so far for COTI. Keywords used about this post are: COTI price prediction, COTI crypto price prediction, where appropriate.

COTI is available in Noone Wallet; manage it end-to-end — store, buy, swap, send, and receive — while keeping complete ownership of your private keys.

What is COTI (COTI)?

COTI is a blockchain payments-focused project designed to deliver a low-cost, scalable payment network. The protocol combines a directed acyclic graph (DAG)-based conception together with traditional blockchain constructs to allow for higher volumes of processing and reduced fees. COTI, the native token, is used to settle fees, to fuel some on-network services, and to underwrite payment rails that the project offers to partners and merchants.

The project positions itself as an alternative/infrastructure layer to card rails and legacy payment systems. Long-term adoption levers include merchant onboarding, wallet integrations, and payment instruments. Readers can consult market pages and technical charts for live and historical metrics.

COTI Price Prediction (2025, 2027, 2030, 2035, 2040)

Following the table, each year has a short justified note. Forecasts consider the current market situation, COTI’s payments specialization, historical volatility, and plausible adoption scenarios. All forecasts are scenarios, not guarantees.

Price prediction table

Year | Price Prediction (USD) | ROI if you buy today (based on $0.044) |

|---|---|---|

2025 | $0.08 | 81.82% |

2027 | $0.06 | 36.36% |

2030 | $0.20 | 354.55% |

2035 | $0.50 | 1,036.36% |

2040 | $1.20 | 2,627.27% |

How these forecasts were chosen — brief remarks

2025 — $0.08 (short-term recovery)

A modest market rally or rekindled merchant relationships may lift the price to around $0.08 by end-2025. This presumes moderate on-chain usage and improved sentiment in crypto markets. Possible catalysts include new listings, product releases, or renewed retail interest. Market depth and recent trading ranges justify a plausible move to this level.

2027 — $0.06 (post-cycle consolidation)

Markets often rotate after short-term bull moves. If macro headwinds or crypto-specific regulatory pressure appear, COTI could consolidate. This scenario assumes continued adoption but a broader sideways-to-mildly-up market environment.

2030 — $0.20 (broader niche adoption)

By 2030, if blockchain-based merchant rails and crypto payments gain material share, payment-focused projects could benefit. In this scenario COTI achieves acceptance among niche merchants and wallet vendors, pushing price toward $0.20.

2035 — $0.50 (business + retail penetration)

If merchant integration and scalable payments become mainstream and COTI remains technically competitive, a mix of institutional and retail demand could drive the price higher. This requires sustained adoption and competitive product positioning.

2040 — $1.20 (major adoption extension)

Long-term bull case where crypto payment rails capture significant real-world share. Either COTI becomes a niche standard or token utility materially increases. High uncertainty remains due to regulation, competition, and real-world adoption timelines.

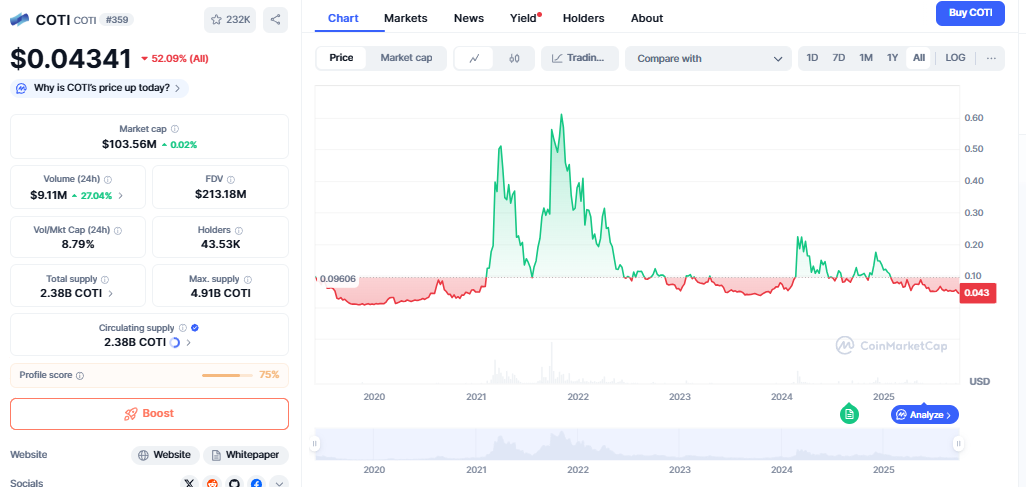

COTI — Price Analysis for the Past Several Years

This section captures prior market cycles, notable dates, and main price drivers. For raw historical figures consult aggregators such as CoinMarketCap, CoinGecko, and TradingView.

Historical price table

Date | Price (approx) | Why the price moved |

|---|---|---|

2019 (launch period) | $0.01–$0.03 | Early listings and low liquidity; initial market discovery. |

Mar 2020 | $0.02 | Market-wide COVID crash — speculative assets sold off. |

2020–2021 (DeFi wave) | $0.05–$0.30 | Rising crypto interest, DeFi growth and additional listings. |

Oct 2021 (peak rally) | $0.60–$0.92 | Broad crypto bull market; altcoins reached multi-month highs. |

2022 (bear market) | $0.05–$0.40 | Market correction, macro and regulatory pressure; many tokens retraced. |

2023 | $0.04–$0.12 | Low liquidity and selective recoveries; limited on-chain usage growth. |

2024–2025 | $0.04–$0.08 | Sideways trading with occasional spikes tied to announcements and exchange flows; snapshot near $0.044 (Sep 29, 2025). |

Narrative Abstract

COTI’s price trajectory follows a common small-cap utility token pattern: low liquidity in early stages, strong upside during broad bull markets, and steep declines during bear periods. Key catalysts historically have been market sentiment, exchange listings, and product releases aimed at merchant adoption. The all-time high occurred during the 2021 bull market; since then price movement has been subdued while the team focuses on payment integrations.

FAQ

Is COTI a good investment?

This article does not provide financial advice. Whether COTI is a suitable investment depends on your risk tolerance, time horizon, and view on blockchain payments. COTI is speculative and highly volatile.

How much will COTI be worth in 10 years?

See the scenario table above. Under the moderate adoption scenario presented here, the 2035 value is $0.50. Long-term projections carry high uncertainty.

Should I buy COTI now?

We cannot stock-pick. Consider portfolio diversification, position sizing, and secure custody if you choose to invest.

What would most influence COTI’s future price?

Major drivers include merchant uptake, competitive payment solutions, token economics, macro crypto cycles, regulation, and exchange liquidity. Real merchant volume and meaningful partnerships would be especially significant.

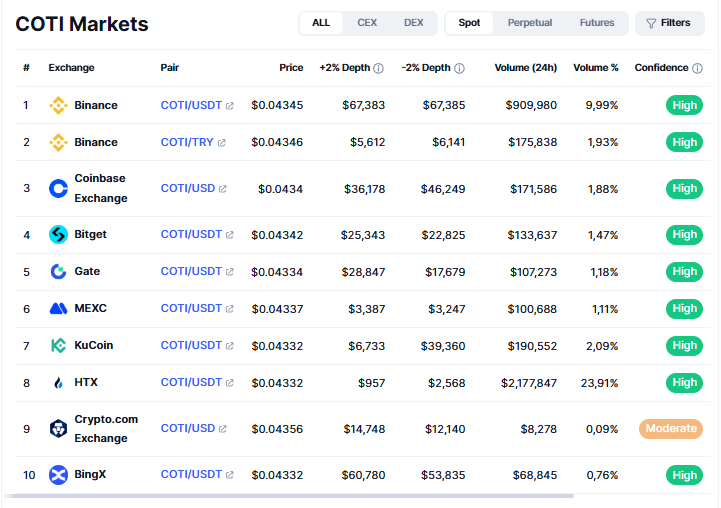

Where can I see live charts and prices?

Use major aggregators and charting sites such as CoinMarketCap, CoinGecko, CoinDesk, and TradingView for live pricing and historical charts.

Conclusion

COTI sits among many payment-infrastructure projects. In the short term, price movements will largely follow market cycles and newsflow. Over the long term, if blockchain payments reach real merchant adoption and COTI secures meaningful integrations, price multipliers could be substantial versus current levels. However, long horizons hold significant probabilities of alternative winners, technology shifts, and regulatory changes. Treat the scenarios above as structured possibilities — not guarantees.

Wrap up with full control of COTI using Noone Wallet — simple, multi-chain management for storage, purchase, exchange, transfers, and receipts.

Related articles (examples)

- Quant price analysis and long-term forecast — Noone Blog

- Ethereum price prediction — Noone Blog

- Bitcoin price charts — Noone Blog

Major external sources used

CoinMarketCap, CoinGecko, CoinDesk, TradingView.