Coq Inu (COQ) Price Prediction 2025–2040

Disclaimer: The following document is not meant to be educational. It's not investment advice. Always research on your own before coming to any conclusions about investments.

Introduction

This is a Coq Inu cost projection post. Is Coq Inu worthy of attention in 2025, 2027, 2030, 2035 and 2040? What might COQ potentially be worth then and what return will an investor make if purchasing now? Below is a logical set of scenarios, a concise forecast table with ROI, and a brief commentary of Coq Inu’s recent price movement and drivers.

Start managing Coq Inu (COQ) with confidence using Noone Wallet — a trusted non-custodial wallet supporting 1,000+ assets for secure storage, buying, and exchange.

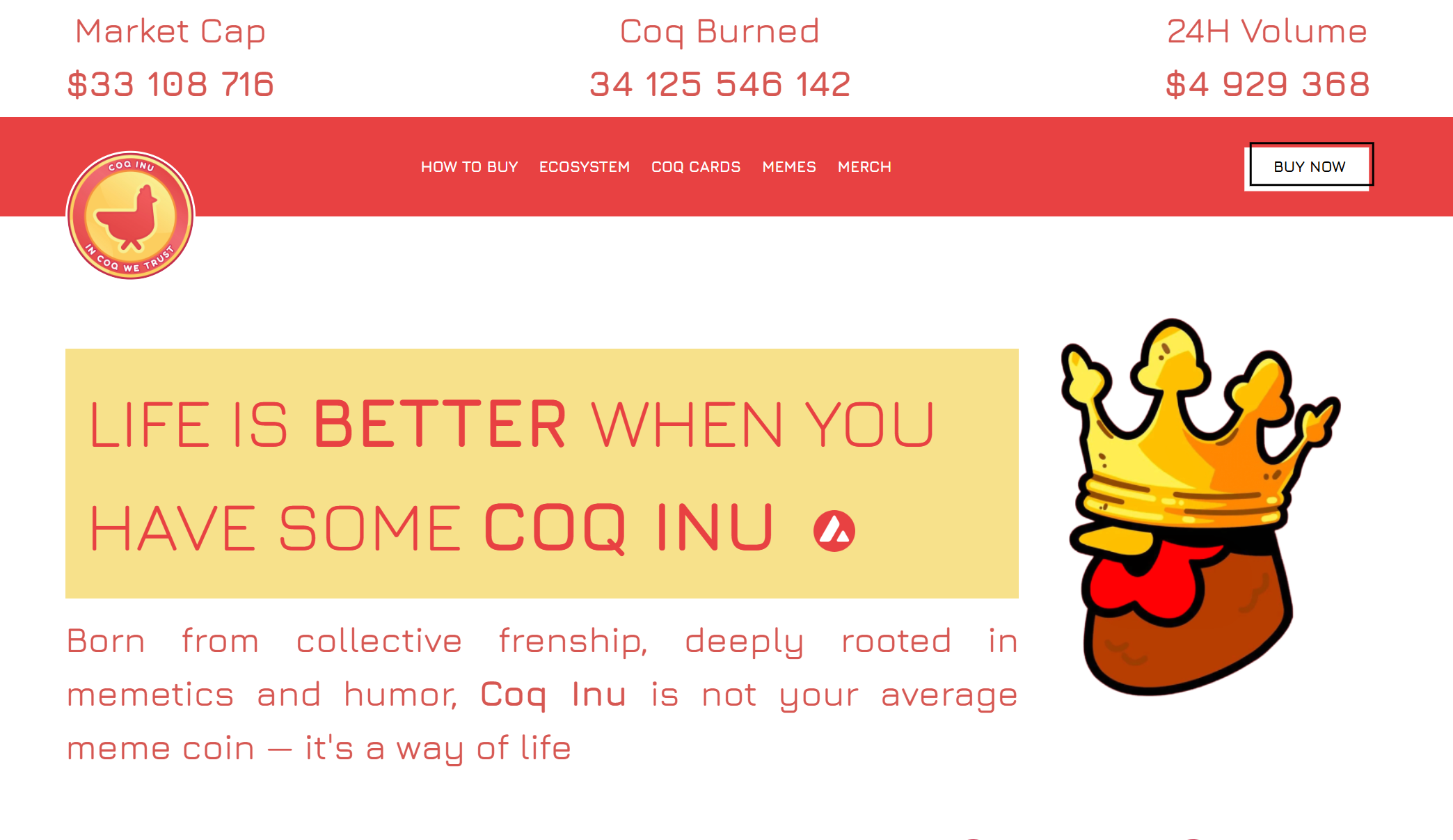

What is Coq Inu (COQ)?

Coq Inu is a high-supply memecoin launched into the Avalanche / DeFi ecosystem and listed on various DEX venues. Like other meme initiatives, COQ’s dynamics combine liquidity-driven trading, community promotions, and episodic exchange listings that trigger spikes. Tokenomics (notably very large total/circulating supply) and liquidity on AMM pools and CEX order books determine price action. New on-chain liquidity pools and DEX listings produce busy but often short-lived liquidity, making COQ prone to large short-term moves.

Main determinants of COQ’s future price

- Market sentiment for meme / small-cap coins (highly cyclical).

- Exchange listings / delistings (listings can cause immediate pumps).

- Liquidity & pool depth on DEXes and AMMs (affects volatility).

- Supply mechanics (circulating vs total supply, burns or unlocks).

Coq Inu Price Prediction (2025–2040)

Starting price used to calculate ROI: $0.00000048 (approx.), live mid-price on Oct 1, 2025. Projections are scenario-based, not guarantees.

Price forecast table

Year | Price prediction (USD) | ROI vs $0.00000048 |

|---|---|---|

2025 | $0.00000100 | +108.33% |

2027 | $0.00000080 | +66.67% |

2030 | $0.00000300 | +525.00% |

2035 | $0.00001000 | +1,983.33% |

2040 | $0.00003000 | +6,150.00% |

(ROIs rounded to two decimals; base price ≈ $0.00000048 on October 1, 2025.)

Why these scenarios?

2025 — $0.00000100 (short-term rally)

Memecoins often have swift short-term moves when risk appetite returns or after Tier-1 / CEX listings. A near-term pump to ~ $0.000001 is possible if COQ gains wider exchange exposure or a coordinated community campaign. This is highly speculative; available liquidity and sell-pressure limit rally magnitude.

2027 — $0.00000080 (post-pump consolidation)

After speculative pumps many meme tokens trade sideways as hype fades. This consolidation assumes no durable utility emerges and episodic selling by large holders continues to exert pressure.

2030 — $0.00000300 (re-rating + organic growth)

In a long-term bullish small-cap scenario COQ could benefit from repeated speculative cycles, wider exchange pairs and deeper AMM depth, lifting market cap multiple times above today’s level while remaining small-cap.

2035 — $0.00001000 (continued higher market)

Stretch case assuming sustained speculative interest across cycles, repeated liquidity injections, and persistent social narrative. For memecoins, long-term higher prices rely more on community dynamics and listings than fundamentals.

2040 — $0.00003000 (optimistic, high-uncertainty)

Highly optimistic outcome requiring unusual alignment of repeated speculation, major tokenomics changes (e.g., massive burns), or structural shifts. Extremely unlikely without dramatic changes to supply or demand dynamics.

Recent prices and historical comments

Coq Inu’s historical candles show large daily swings and short, spike-sized upruns tied to exchange listings and social hype. Annual summaries show COQ mainly traded in the 10⁻⁶ to 10⁻⁷ USD range during 2023–2025 with episodic spikes. Real-time historical candles are available on CoinMarketCap and exchange history pages.

Shortlisted timeline (representative)

Period | Events / Price behavior |

|---|---|

2023–2024 | Project start and initial DEX listings; extreme volatility in low 10⁻⁶ USD range. |

2024–2025 | Repeated spikes from new pools, marketing pushes and sporadic listings; market cap rose into tens of millions during spikes. |

Mid-2025 | Multiple high-volume listings and liquidity injections caused spikes, followed by retracements as selling pressure surfaced; liquidity concentrated in select Avalanche AMM pools and smaller CEX order books. |

Narrative account

COQ behaves like a standard high-supply memecoin: potential for rapid upside on hype and listings, but large downside risk from poor liquidity, supply pressure, and deleveraging in risk-off periods. Monitor exchange flows, AMM pool depth and social signals to gauge near-term direction.

FAQ

Is COQ a good buy?

This is not investment advice. COQ is a meme cryptocurrency with very high volatility and extreme downside risk. Suitable only for traders who can accept the possibility of total loss.

What might COQ trade at in 10 years?

Extremely uncertain. The 2035 scenario in this piece places COQ near $0.00001, but that requires repeated speculative enthusiasm or major tokenomics changes to reduce floating supply.

Should I buy COQ now?

No trade recommendations are provided here. If considering purchase, use strict position sizing, diversify, and ensure secure custody—be prepared for extreme volatility.

What drives COQ’s price most?

Exchange listings, social velocity, AMM liquidity shifts and large-holder activity. Macro risk events and regulatory shocks can also move price dramatically.

Where to watch live prices and charts?

CoinMarketCap, CoinGecko, Binance, KuCoin and DEX pages. Cross-reference multiple sources for thinly traded tokens.

Conclusion

Coq Inu is a highly speculative memecoin: short-term pump-and-dump surges driven by listings and social hype are common; long-term value would depend on sustained community engagement or radical tokenomic changes. The scenarios above outline potential price corridors from near-term pumps to long-term stretch outcomes — treat them as possibilities, not certainties.

Store, buy, exchange, send, and receive Coq Inu (COQ) securely with Noone Wallet — a non-custodial wallet that keeps your crypto completely under your control.