Beam (BEAM) — Price Prediction 2025–2040

Disclaimer

This content is provided for informational purposes only and is not investment advice. Cryptocurrency prices can move rapidly and are highly volatile. Always do your own research before making any investment decisions.

Introduction

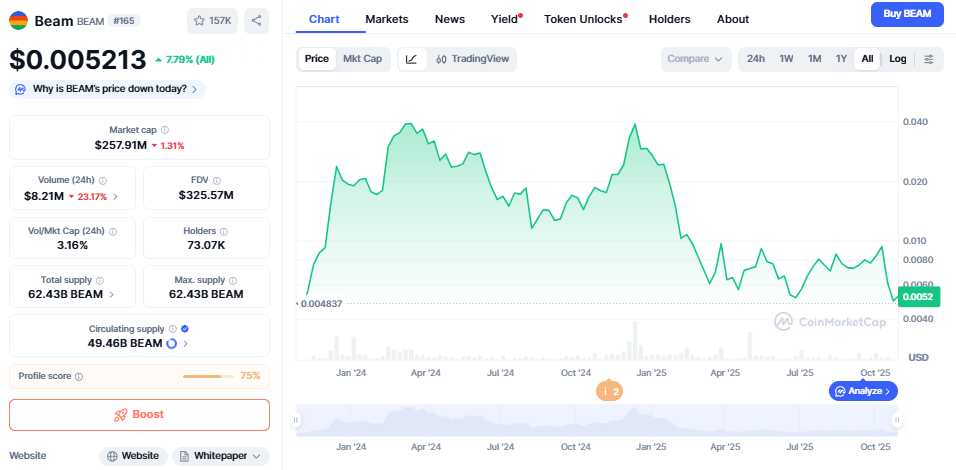

Beam (BEAM) is a gaming- and metaverse-focused blockchain token that emerged from the Merit Circle ecosystem. As blockchain gaming and NFT economies gain traction, Beam aims to provide infrastructure and token utilities for game developers, players and in-game marketplaces. This report summarizes Beam’s fundamentals, historical price action, and scenario-style price forecasts for 2025–2040.

You can buy, store, and exchange BEAM safely with Noone Wallet, a secure, non-custodial crypto wallet supporting over 1,000 assets across multiple blockchains — giving you full control over your private keys.

What is Beam (BEAM)?

Beam is the rebranded token that evolved from Merit Circle (MC). The Beam Network (on Avalanche) targets game economies, NFT markets, and interoperability tools for developers and players. Key points:

- Ecosystem: Gaming DAO → Beam Network (developer tools, marketplaces, tokenized assets).

- Use cases: In-game economies, NFTs, staking/governance within the Merit Circle / Beam ecosystem.

- Risk profile: Small market cap relative to larger gaming projects — higher upside potential but higher risk.

Price Predictions (2025–2040)

The table below shows scenario-style price targets and approximate ROI measured from the reference price ($0.005229).

Year | Price prediction (USD) | Approx. ROI (from $0.005229) |

|---|---|---|

2025 | $0.0105 | +101% |

2027 | $0.0085 | +62.6% |

2030 | $0.0450 | +760.5% |

2035 | $0.1100 | +2,004% |

2040 | $0.2200 | +4,106% |

Scenario Narratives

2025 — Short term: $0.0105 (+101%)

Market recovery and new ecosystem partnerships could double BEAM from current levels. This assumes renewed interest in gaming tokens and modest adoption of Beam Network features.

2027 — Consolidation: $0.0085 (+62.6%)

A natural post-cycle consolidation may occur. If Beam maintains steady network activity but broader sentiment cools, a mild pullback to ~$0.0085 is plausible.

2030 — Adoption phase: $0.0450 (+760.5%)

If blockchain gaming integrates with mainstream entertainment and Beam becomes a commonly used infrastructure for game economies, the token could reach this mid-term target.

2035 — Maturity: $0.1100 (+2,004%)

With mature metaverse projects and cross-game interoperability, Beam could capture significant utility and token velocity, supporting a multi-fold increase.

2040 — Bull case: $0.2200 (+4,106%)

In a best-case scenario where decentralized gaming scales widely and Beam remains a core infrastructure piece, long-term appreciation could reach this level — note high uncertainty at this horizon.

Price Prediction Table

Year | Price (USD) | ROI |

|---|---|---|

2025 | $0.0105 | +101% |

2027 | $0.0085 | +62.6% |

2030 | $0.0450 | +760.5% |

2035 | $0.1100 | +2,004% |

2040 | $0.2200 | +4,106% |

Historical Price Analysis

Beam’s history (transition from Merit Circle → Beam) and notable price events:

Date | Price | Event / Influence |

|---|---|---|

Nov 04, 2021 | $2.88 | Merit Circle launched during play-to-earn bull market |

Jan 20, 2022 | $1.25 | Market correction; waning play-to-earn interest |

Jun 13, 2022 | $0.48 | Broad bearish cycle |

Sep 05, 2022 | $0.90 | Community engagement & new partnerships |

Dec 29, 2022 | $0.28 | Continued bearish pressure |

Mar 19, 2023 | $0.40 | Renewed interest in gaming DAOs |

Jul 18, 2023 | $0.21 | Volatility across crypto markets |

Dec 20, 2023 | $0.15 | Project adjustments / market shifts |

Jan 24, 2024 | $0.008 | Token swap / rebrand to Beam (supply adjustment) |

Apr 11, 2024 | $0.007 | Stabilization after rebrand |

Jul 09, 2024 | $0.006 | Early Beam Network integrations with game studios |

Oct 28, 2025 | $0.005229 | Current market price (consolidation) |

Note: Past price movements reflect both macro crypto cycles and gaming-specific sentiment shifts.

Key Drivers & Risks

Drivers

- Adoption of blockchain gaming and NFT economies.

- Developer integrations and partnerships with game studios.

- Successful launch and utility of Beam Network tools and marketplaces.

Risks

- Low market capitalization and liquidity → higher volatility.

- Competition from other gaming/metaverse blockchains and layer-1s.

- Execution risk (product delivery, developer adoption).

- Broad crypto market downturns and regulatory changes.

FAQ

Can I invest in Beam (BEAM)?

Beam targets the gaming/metaverse market and may appeal to speculative investors who believe in blockchain gaming’s long-term growth. It is high risk — invest only what you can afford to lose.

What might BEAM be worth in 10 years?

Under the scenarios above, a midpoint long-term estimate (2035) is ~$0.11, assuming steady adoption of blockchain gaming and Beam’s relevance.

Should I buy BEAM now?

At ~$0.005229, Beam may be attractive to long-term, risk-tolerant investors who believe in its roadmap. Always combine this with your own research and portfolio considerations.

How do I store BEAM?

Use a reliable non-custodial wallet (for example, Noone Wallet) that supports the token and gives you control over private keys.

Conclusion

Beam (BEAM) represents a play on the long-term growth of blockchain gaming and metaverse economies. While the token shows upside in long-term adoption scenarios, it remains a high-risk asset due to market volatility, small market cap, and execution dependencies. Track developer integrations, network usage metrics, and ecosystem partnerships as primary signals of progress.

You can manage BEAM and other cryptocurrencies securely with Noone Wallet, a non-custodial wallet designed to give you full control over your digital assets.

Sources

CoinMarketCap, CoinGecko, CoinDesk, Decrypt, Beam Network documentation, DappRadar.