Aerodrome Finance is part of the growing decentralized finance (DeFi) ecosystem, built to operate as a key liquidity hub on Base, an Ethereum Layer 2 network. As DeFi platforms continue to evolve, Aerodrome aims to streamline token swaps and liquidity provision using automated market maker (AMM) technology. By integrating vote-lock governance and incentive-driven mechanics, it reflects a broader trend in DeFi toward community participation and optimized trading infrastructure. This overview explores the core features, governance model, and technological foundation of Aerodrome Finance, offering a neutral look at its role within the Base network and the wider Ethereum-based DeFi landscape.

What is Aerodrome Finance (AERO)?

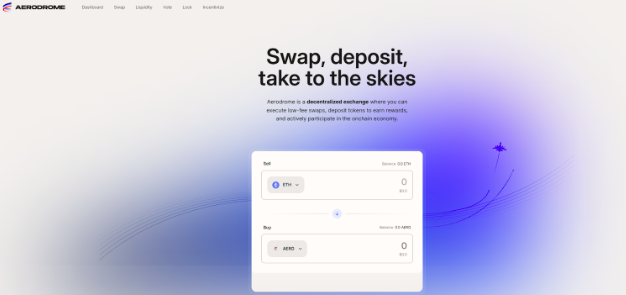

Aerodrome Finance is a decentralized finance (DeFi) protocol built on the Base network, functioning primarily as an automated market maker (AMM) and liquidity hub. It is designed to facilitate token swaps while attracting liquidity through a system of incentives. Aerodrome integrates features from Velodrome V2, aiming to provide efficient trade execution and encourage user participation via governance mechanisms.

The platform employs a vote-lock governance model, where users can lock AERO tokens to gain voting power. This structure allows participants to influence key decisions, such as reward distribution or protocol upgrades. While this model promotes community involvement, it also introduces long-term commitment requirements for those seeking governance rights.

Aerodrome’s liquidity incentive engine is a central feature, offering rewards to users who provide liquidity to various pools. This aims to ensure steady capital flow across the platform but may also lead to inflationary pressures on the AERO token if not managed carefully.

The protocol is built to support Base, an Ethereum Layer 2 network, and leverages existing DeFi mechanisms, combining aspects of Uniswap, Curve, and Convex. Its design prioritizes efficiency and usability, with an interface intended to accommodate both beginners and experienced users.

While Aerodrome Finance presents itself as a core infrastructure piece for Base’s ecosystem, its long-term relevance will likely depend on sustained liquidity, governance participation, and adoption across the DeFi space. The project represents a broader trend of merging established AMM models with vote-based incentive structures in emerging blockchain environments.

Aerodrome Finance (AERO) Price Prediction for 2025, 2027, 2030, 2035, 2040

As of April 7, 2025, AERO is trading at $0.31, with a market capitalization of $254.4 million. This places it around the 140th position on CoinMarketCap.

In the table below, you’ll find our price predictions for Aerodrome Finance (AERO) for the years 2025, 2030, 2035, and 2040. Following the table, we provide a detailed explanation of our forecast. These predictions are based on a combination of both fundamental and technical analysis, reflecting current market conditions, project development, and broader trends in the crypto space.

| Year | Price Prediction | ROI of your investment (if you buy the coin now) |

| 2025 | $0.9 | 190.32% |

| 2027 | $0.5 | 61.29% |

| 2030 | $9 | 2,803.23% |

| 2035 | $12 | 3,770.97% |

| 2040 | $22 | 6,996.77% |

2025

2025 has started with a number of significant changes in the market. One of the biggest is the signing of the crypto reserve act by U.S. President Donald Trump, with Bitcoin expected to be included in that reserve. Another major development is the resolution of the SEC case against Ripple. Together, these events send a strong signal to investors that cryptocurrency is becoming a major game changer in the global economy. Although the year began with a market decline due to recession fears and geopolitical uncertainty, the crypto market is expected to grow significantly later this year. It’s possible that AERO’s price will rise alongside the broader market, potentially reaching $0.9 by year-end.

2027

As the next Bitcoin halving approaches, 2027 will likely be marked by volatility and market decline. Historically, the year before a halving is considered a “crypto winter.” After previous bull cycles, a market correction usually follows, and 2027 may reflect that trend.

2030

By 2030, the crypto market will likely mature through wider adoption and clearer regulation. Bitcoin and Ethereum may still lead, but faster, more efficient blockchains could gain ground. DeFi and tokenized real-world assets (like stocks and real estate) might become mainstream. Governments may launch CBDCs, which could compete with but also promote blockchain use. AI and smart contracts could automate many financial services. If growth continues, the total market cap could reach $10T, making crypto a normalized part of global finance. AERO’s price might rise to $9 by the end of 2030.

2035

By 2035, it’s highly likely that digital assets will replace traditional forms of money. As institutional traders continue to enter the market, crypto adoption is expected to grow significantly. Many countries may not only hold cryptocurrencies as part of their reserves but also introduce national digital currencies. This shift toward digital finance could transform the global economy, making transactions faster, more secure, and accessible. Compared to the current state of the market, the crypto space is expected to expand dramatically. Blockchain technology will likely play a central role in financial systems, leading to more transparency and innovation across industries. The future of money is becoming increasingly digital. AERO’s price could hit $12 by the end of 2035.

2040

2040 is difficult to predict, as many changes will occur in the financial, political, and geographical landscapes. It’s unclear how the crypto market will integrate into everyday economic and social life. If the AERO project remains active through the years, the token’s price could reach $22 by the end of 2040.

Aerodrome Finance (AERO) Price Analysis for the Past Several Years

| Date | Price | Why the price dropped/rose to this level (what influenced the price change) |

| Oct 17, 2023 | $0.00001861 | AERO reached its all-time low at approximately $0.00001861. This sharp decline was due to initial low adoption and limited market awareness following its launch. |

| Sep 3, 2024 | $0.58 | The price rose to around $0.58, marking a 4.5% increase against the US dollar within 24 hours. This uptick has been driven by growing interest in decentralized exchanges on the Base blockchain. |

| Sep 18, 2024 | $0.77 | AERO traded at approximately $0.77, reflecting a 37.5% increase over the week. The surge was attributed to positive market sentiment and increased trading volume. |

| Sep 29, 2024 | $1.18 | The token's price reached $1.18, continuing its upward trend. This increase was influenced by heightened demand and favorable market conditions. |

| Oct 9, 2024 | $1.22 | AERO's price climbed to $1.22, with a 15.2% gain over the previous week. Factors contributing to this rise may include strategic partnerships and platform developments. |

| Oct 12, 2024 | $1.28 | The token traded at $1.28, marking a 10.5% increase over the week. This growth is linked to the platform's expanding user base and increased total value locked (TVL) |

| Dec 7, 2024 | $2.33 | AERO achieved its all-time high of $2.33. This peak was likely driven by significant platform milestones, such as surpassing $40 billion in cumulative volume and the success of new offerings like cbBTC. |

Q&A

Is AERO a Good Investment?

This article does not provide investment advice. Please conduct your own research before making any investment decisions.

What Will Be the AERO Price in 10 Years?

By 2035, it’s possible that AERO could reach a price of $12, depending on market trends, project development, and broader crypto adoption.

Should You Buy AERO Now?

As of April 2025, AERO is still trading far below its all-time high. If, after conducting independent research, you believe in the project’s long-term potential, you may consider adding it to your portfolio.

Conclusion

Between 2024 and 2025, AERO’s price has experienced several fluctuations, largely mirroring Bitcoin’s movements. It appears to be one of many crypto assets whose value is closely tied to Bitcoin’s performance. As of April 2025, sentiment on CoinMarketCap remains strongly positive, with 92% of the community feeling bullish about AERO.